Market Picture

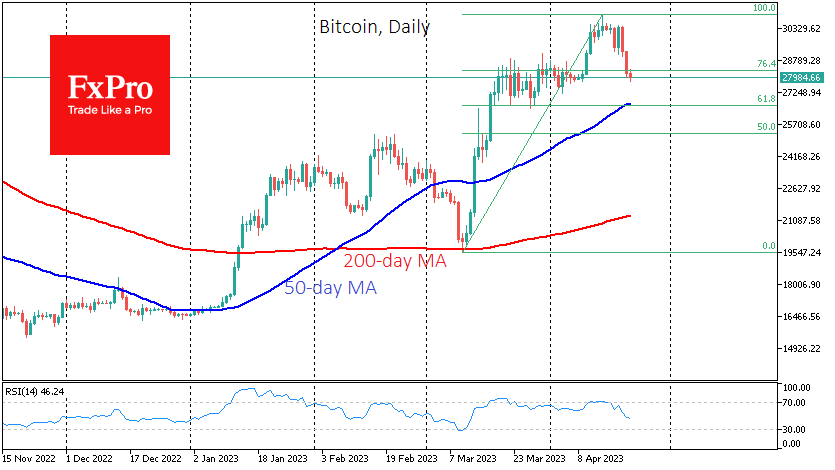

Bitcoin fell to $28K on Thursday, losing 2.8% in the last 24 hours. The crypto market is shrinking roughly at the same rate, losing 2.5% to $1.19 trillion.

Bitcoin has completely wiped out the gains since 9th April and gave up 23.6% of the rally from the March lows. It is worth bracing for a more typical pullback of 38.2% from the rally to the 50-day average, near $26.7K. Such a drop promises to fray the nerves of crypto enthusiasts. A break below that level could quickly take the price to $25.6K – the all-important 200-week moving average, the capture of which allowed the bull market to be declared resurgent in March.

Similarly, the Ethereum exchange rate returned to $1915 when the rally began on the 13th. Significant support is seen in the $1840-1850 area, where the lows of 9th April and the Fibonacci retracement are concentrated.

As a result of another recalculation, bitcoin’s mining difficulty rose 1.72% to 48.71T. Over the past seven days, the average hash rate hit a record high of 356 EH/s, showing that miners are increasing their processing power.

News background

The EU has agreed to regulate cryptocurrencies. The EU Parliament has voted for the MiCA draft law, which supplies comprehensive industry regulation. Market participants will no longer have to navigate 27 different national regulatory laws, notes Chainalysis.

Société Générale-Forge (SG-Forge), a unit of French banking giant Société Générale, has launched an Ethereum-based EUR CoinVertible stablecoin pegged to the euro.

Somebody moved 6,071 BTCs after nine years of hibernation, the Whale Alert service detected on 19th April. After a large tranche, 3999 BTCs were returned to the original wallet. One Telegram channel suggested that the original Mt. Gox exchange owner and Ripple creator Jed McCaleb could be behind the transactions.

The FxPro Analyst Team