The cryptocurrency market has gained another 1.8% over the past 24 hours, bringing its total capitalisation to $2.28 trillion. The index has been choking on growth for the past three weeks at the $2.3 mark, so further rise promises to strengthen the bullish case, at least in the short term.

The cryptocurrency fear and greed index has jumped to 45. This is a fear territory, but very close to neutral territory. Judging by the continued demand for risky assets in traditional markets and the positive performance of cryptocurrencies as of this morning, this index could well continue to rise at the end of the day.

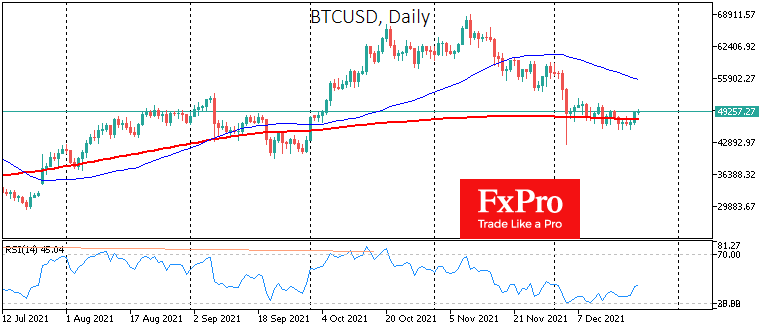

Bitcoin is trading near $49,000, returning to the highs of the last week and a half, adding 1.3% in 24 hours and 2.3% over seven days.

Technically, the first cryptocurrency managed to close noticeably above its simple 200-day moving average, which could spur demand from those buyers who were waiting for the battle for that important level to unfold.

The price of Ether is above $4K, which is also a positive signal for the entire crypto market.

The situation looks like Ether staying above $4K and Bitcoin staying above the 200-day average is fuelling buying among smaller altcoins. Keeping key currencies above psychological marks fuels hopes that the market has not switched to bearish mode.

On the other hand, we remain wary of the crypto market outlook, noting that Bitcoin and Ether look like clinging to meaningful levels. The bearish scenario can only be cancelled if growth develops from current levels.

The FxPro Analyst Team