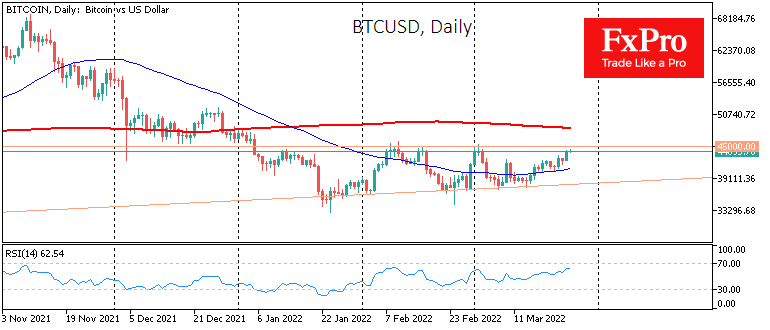

Bitcoin is trading above $44.1K on Friday, gaining 2.4% over the past day and 8.2% over the week. Yesterday, the first cryptocurrency was in demand during the Asian and American sessions.

The current values of BTC are consolidating in the area of 2-month extremes. In contrast to the previous test of these levels, this time, we see a smooth rise in the rate, indicating that the bulls still have some momentum.

Also over the past 24 hours, Ethereum has gained 2.4%, while other leading altcoins from the top ten have strengthened from 0.5% (XRP) to 7.4% (Solana). The exception is Terra, which is shedding 1.8%, correcting part of its gains in the first half of the week.

According to CoinMarketCap, the total crypto market capitalization increased by 2.3% to $2 trillion. The Bitcoin Dominance Index rose 0.1 percentage points to 41.8%. The Fear and Greed Cryptocurrency Index added another 7 points to 47 and ended up in the neutral territory.

Cardano leads the last week in terms of growth among top coins (+39%) as Coinbase added the possibility of staking cryptocurrency with a current estimated annual return of 3.75% per annum.

Credit Suisse reported that Bitcoin doesn’t pose a threat to the banking sector as an alternative to fiat money and banking services.

The CEO of BlackRock, one of the world’s largest investment companies, noted that military actions in Ukraine and sanctions against Russia will increase the popularity of cryptocurrencies and accelerate their adoption.

Despite the rally in global stocks over the past two weeks, financial conditions in the debt markets continue to deteriorate due to rising interest rates and inflation. Largely because of this, El Salvador has postponed the issuance of bitcoin bonds in anticipation of more favourable conditions. Since very active steps to raise key rates are expected in the next year and a half, and Bitcoin is far from the highs, it is unlikely that such bonds will be issued soon.

The Bank of England intends to tighten supervision of cryptocurrencies due to the financial risks that their adoption carries. However, the Central Bank urged commercial banks to exercise maximum caution when dealing with these extremely volatile assets.

The FxPro Analyst Team