Market picture

The crypto market has risen 1.5% in the last 24 hours to reach a capitalisation of $1.2 trillion. Almost all the gains have come since the start of the day, coinciding with a fresh bout of fear surrounding US regional banks.

US index futures have risen modestly since the start of the day as the banking problems bring a monetary policy reversal closer. And that is another reason for buyers, in this case, medium-term buyers, to be happy.

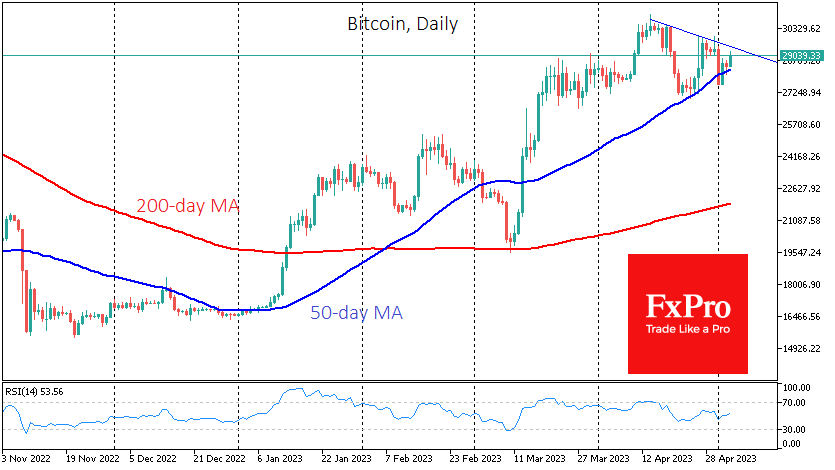

The bulls in Bitcoin have pushed the price to $29K, consolidating above the 50-day moving average. This is an essential signal of a medium-term uptrend. Short-term attention is focused on the $29.4K area, where Bitcoin fell earlier this month, and resistance runs through the local highs of mid to late April. A move higher would pave the way for another test of highs for almost a year.

According to Santiment, bitcoin whales increased their holdings of the first cryptocurrency by 64,000 BTC in April, contrary to the view that the final direction of the asset’s movement has yet to take shape. Major investors continue to believe that there are growth prospects for BTC.

News background

Former Coinbase CTO Balaji Srinivasan lost a $1 million bet on Bitcoin’s rise. He bet BTC would reach $1 million by 17 June but conceded defeat before the deadline. “I burned a million to show everyone how the US government is printing trillions of dollars out of thin air,” the businessman tweeted.

The US president’s administration has proposed a 30% tax on crypto miners to make them more aware of the damage they are doing to the climate. The proposed tax will raise about $3.5 billion over ten years.

Robert Francis Kennedy Jr, a nephew of the 35th US President John F. Kennedy, criticised the SEC and FDIC for their “war on cryptocurrencies”, which he said had led to a banking crisis in the country.

The introduction of retail central bank digital currencies (CBDCs) will lead to “many unintended consequences”, said IMF chief Kristalina Georgieva. Florida Governor Ron DeSantis has vowed to ban the digital dollar in his state.

The FxPro Analyst Team