Bitcoin has been growing during the past 5 weeks, including last week – which was the worst one for stocks over the last month. The total capitalization of digital currencies this week exceeded the psychological level of $400 billion. The last time the crypto market was above this mark was at the end of April 2018. Bitcoin is supported by news about the growth of the Grayscale Bitcoin Trust, which now has almost 500K BTC worth about $6.7 billion. About 70% of the inflow of funds into Grayscale goes to the Bitcoin Trust.

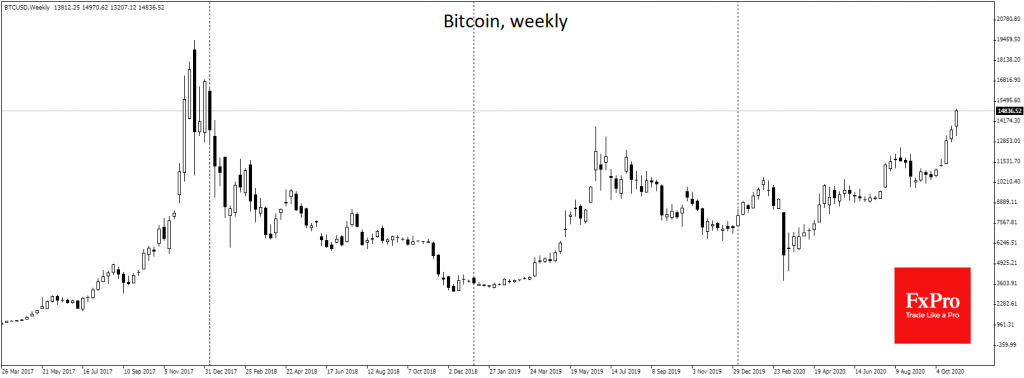

As we mentioned previously, it was important for Bitcoin to overcome the resistance area near $12,000. Once it was passed, the coin did not have any significant hurdles to jump to repeat the rally towards $20,000. All obstacles were crushed, and now any news background is perceived as positive for the leading cryptocurrency.

Bitcoin climbed by 7.7% in the last day and currently trades around $14,900, growing this week along with the S&P 500 and Nasdaq. This is not surprising, as Bitcoin is included in the portfolios of large investors as a risk asset. In addition, the Bitcoin dominance index spiked by almost 3% over the last week, approaching 65%. Capital is flowing towards Bitcoin and since we are witnessing the growth of the dominance index along with the price, it should be taken as a positive signal.

Very soon, the interest in the crypto market may become wider again, moving from the first crypto coin to the top 10 and further to a wider list of altcoins. We can already see the first signs of this dynamic with Ethereum (ETH) being the standout.

During the last 24 hours, Ethereum (ETH) climbed by more than 6% to $404 on the news of the ETH 2.0 launch. This is long-awaited news for the community, which can be seen in the price increase. The developers have already opened the possibility of staking for ETH holders. According to ETH 2 Launchpad, at the moment almost 16,300 ETH have been attracted to it. According to analysts Glassnode, the MainNet can be launched on December 1st.

The FxPro Analyst Team