Bitcoin rose 5.3% over the past week, finishing near $22,300. However, the cryptocurrency’s intra-week dynamics are not so rosy, as a moderate downtrend has returned to the market since July 20. Ethereum also declined for most of the week but added 6.6% at the end, to $1525.

The total capitalisation of the crypto market, according to CoinMarketCap, is back to $1009bn at the time of writing, although it was rising to $1082bn in the first half of last week. Bitcoin’s dominance index fell 0.5 percentage points to 41.5% over the same period.

The cryptocurrency fear and greed index rose 10 points to 30 for the week and moved into “fear” from “extreme fear”.

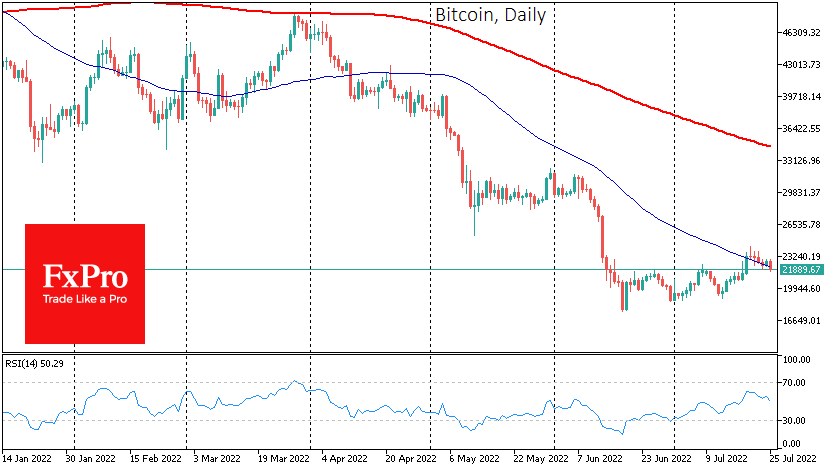

Bitcoin blew an opportunity to consolidate above its 50-day moving average, and for the sixth consecutive trading session, it has been circling that downward curve.

Bitcoin shot off like a rocket last Monday and Tuesday but has been on a gentle descent ever since.

This is a significant signal that the bearish trend remains dominant, and most active players stick with the “sell on the rise” strategy. The technical oversold has already been removed, so there is nothing to deter the bears from a new attack.

The medium-term market participants should prepare for a new test of last month’s support of around 19000. Another bullish success could inspire the buyers. But it’s still worth paying attention to stock performance. If they continue to melt away, big support won’t hold on.

According to Citigroup, the acute phase of deleveraging and panic in the markets is over. According to Arcane Research, major institutions have sold more than 236K bitcoins since May 10, worth more than $5.4 billion.

Luna Foundation Guard’s liquidation of BTC collateral was the largest, with more than 80,000 BTCs sold. Tesla got rid of 29,060 BTC. Another 24,500 bitcoins were sold by the Canadian exchange fund Purpose BTC. Miners sold more than 19,000 BTC between May and June. Boston Consulting Group, Bitget and Foresight Ventures presented a joint study that estimates the number of cryptocurrency users will reach 1 billion by 2030.

The FxPro Analyst Team