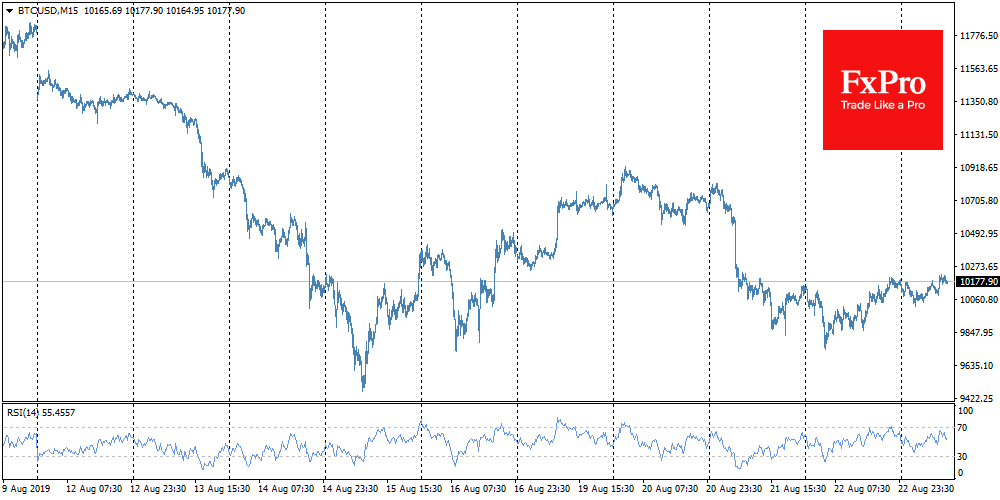

Bitcoin was not even allowed to decline to $9,800 but the growth is not impressive either. At the end of the week, the BTC changes hands by $10,150. The fear and greed index yesterday was at 5 points, which indicated an extreme level of fear, but this morning it jumped to the “usual fear” at 33 points.

Demand for sales and purchases is satisfied quickly enough, which may indicate algorithmic trading in a given range. Large investors may not find it so difficult to maintain a strict range, because trading volumes on popular aggregators are often overestimated.

Until Bitcoin has fallen below $9K, we can consider that we observe a side trend before the new testing of $13-$14K.

The FxPro Analyst Team