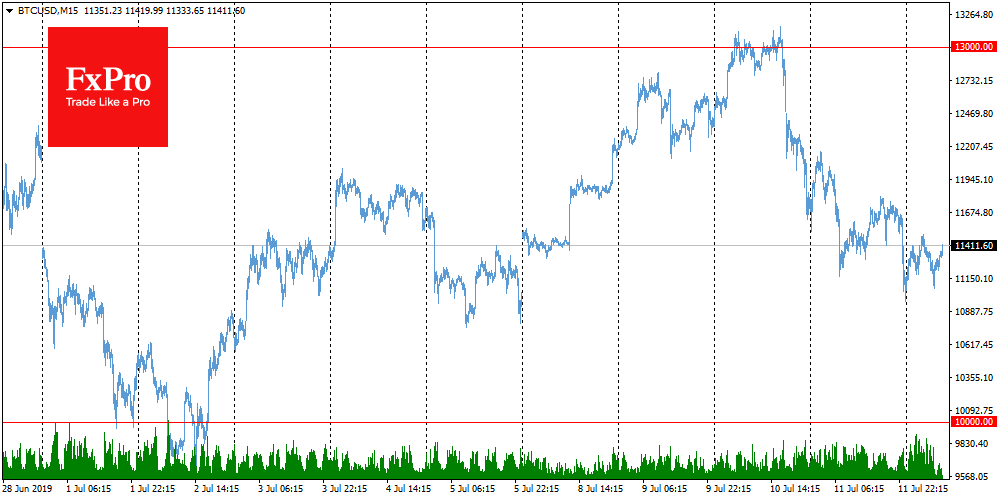

Since July 10, Bitcoin corrected by 13% and is trading at around $11,400 at the end of the week. Optimists cite the fact that the decline was not as sharp as in the last days of June. Pessimists, on the other hand, point out a trend towards a decline in recent days and a consistent increase in trading volumes – a sign of a desire to take profit and close the positions.

Among the reasons for the correction, in addition to rollback after parabolic growth, is also called the statement by Fed Chairman Powell about concerns related to Facebook cryptocurrency – Libra. He joined the choir of opponents of the project, which is still under development. The statement of such a high-ranking official in the world of finance caused pressure on the entire cryptocurrency sector at once.

It is believed that the Facebook statement contributed to the general growth of interest in the crypto sector. If the correction does not continue, Bitcoin will be able to settle near reached levels and hold on for a while, this will be a signal for buyers.

The FxPro Analyst Team