Market Picture

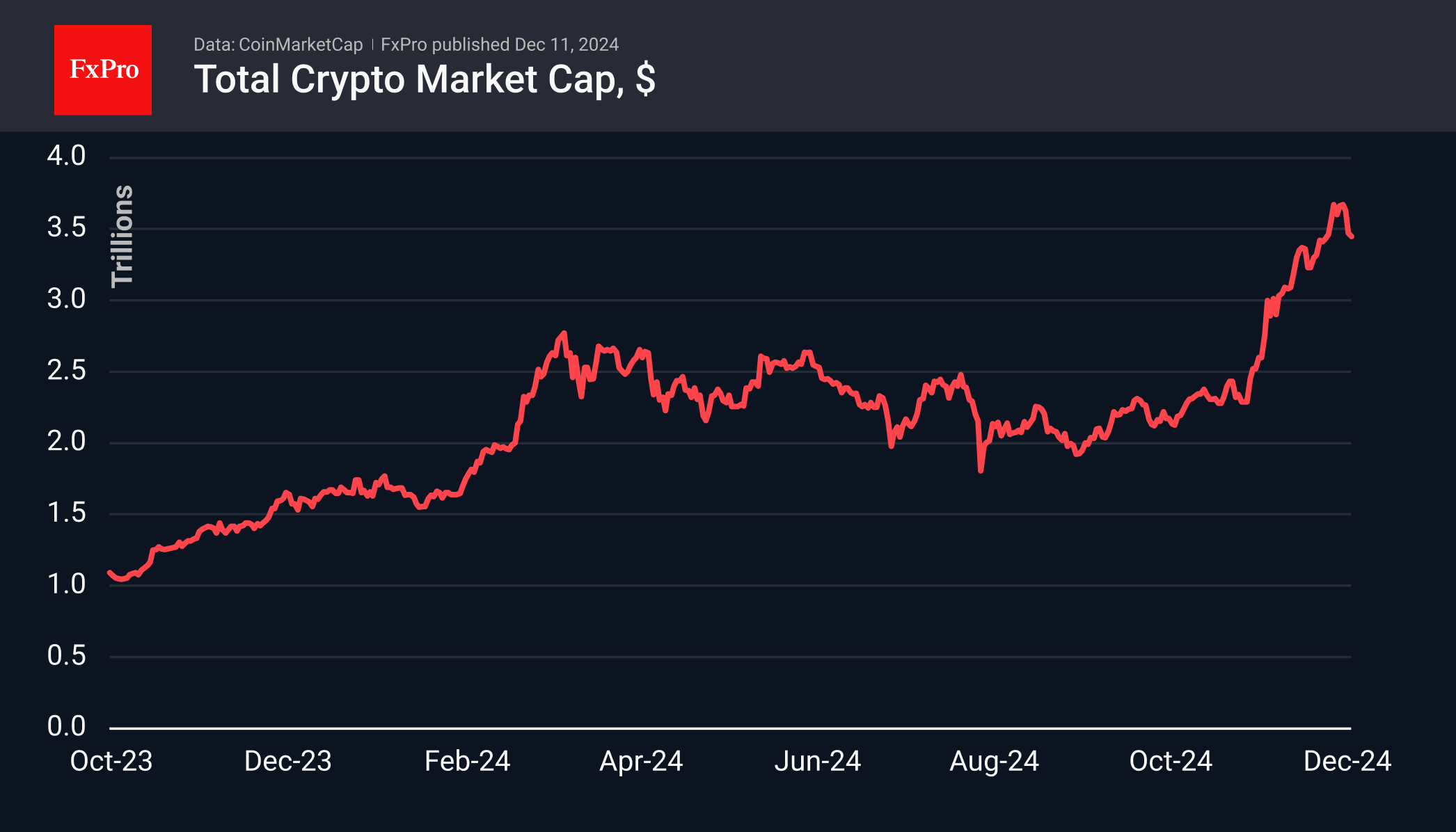

The cryptocurrency market remained roughly the same as the day before at $3.45 trillion, down 7% from its peak levels at the start of the week. The sentiment index rolled back to 74, in ‘greed’ territory. The altcoin season index has pulled back to 63 from a peak of 87 a week earlier. This is a typical story where Bitcoin’s inability to grow soon translates into pressure on altcoins.

There is a meaningful change of ownership for Bitcoin in the $95-100k range. Bitcoin experienced another wave of selling in the US session on Tuesday, just as it did the day before. Once again, buyers retook the initiative when the price dipped under $95k, and at the time of writing, the price has recovered to $98k. The meaningful round level has prompted long-term private holders to sell. At the same time, there is a growing appetite for corporations to buy on their balance sheets. Then, there is the key to how governments holding impressive amounts of confiscated Bitcoins will behave.

For now, we believe Bitcoin is meeting psychological resistance like 2020, when it hesitated to cross $20K at year-end but eventually broke through, doubling in price shortly after. In this cycle, we see upside potential to $120-140K in the next couple of months before the next major shakeout.

News Background

CryptoQuant notes that on 5 December, when the price was at an all-time high, significant transfers from holders could have caused a sharp drop to $90,500.

Stablecoin market capitalisation has surpassed $200 billion, adding 3% in the last seven days. Coinbase attributed the dynamics to a sharp rise in on-chain lending rates.

Mining company MARA Holdings used the proceeds from the bond sale to buy 11,774 BTC for ~$1.1bn at an average price of around $96K per coin. The firm has 40,435 BTC worth $3.9bn in reserves.

Another mining company, Riot Platforms, plans to float $500 million in convertible bonds, using the funds to buy more bitcoins and for general corporate purposes.

The FxPro Analyst Team