Market Picture

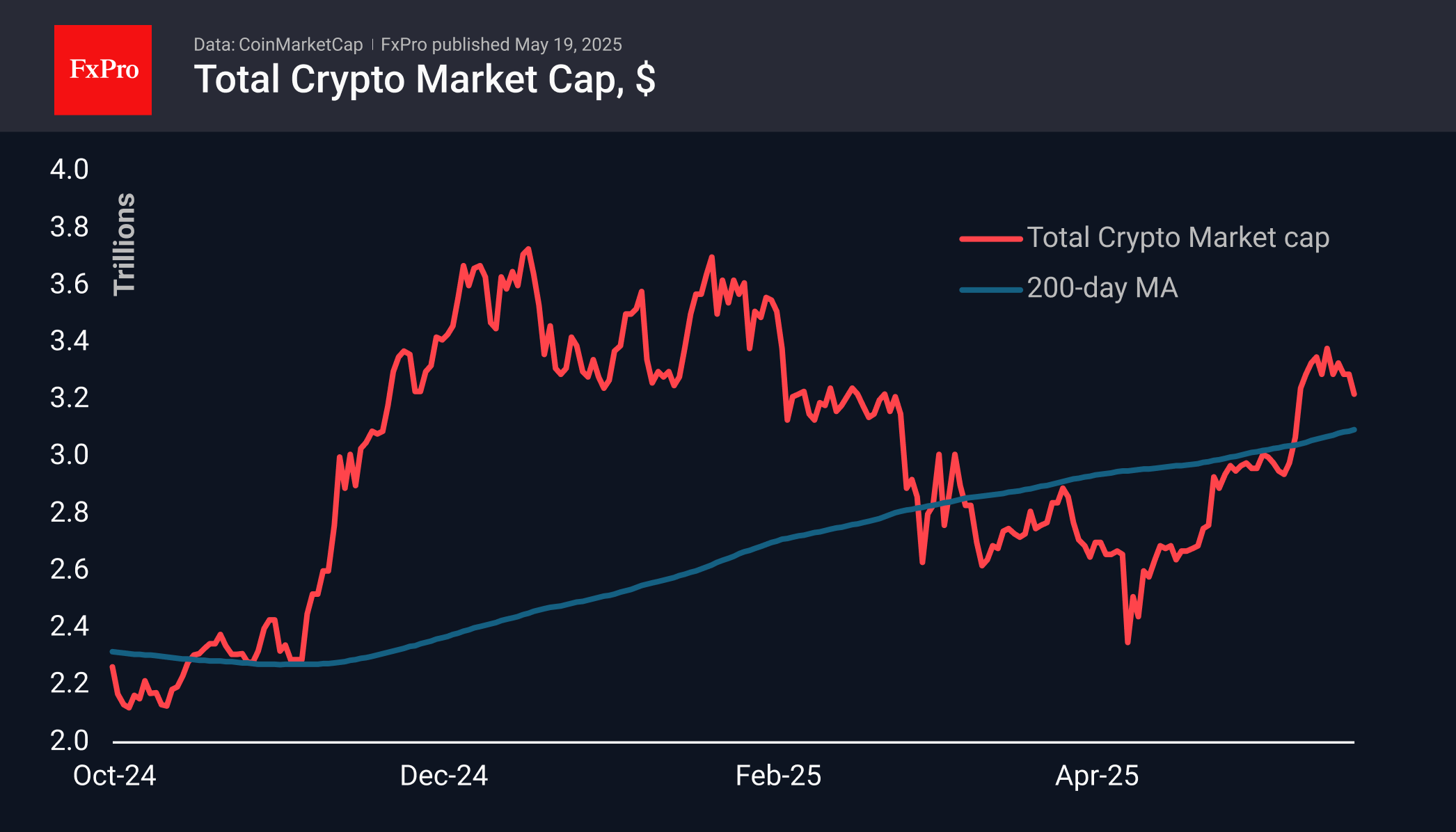

On Monday, the cryptocurrency market declined more than 4% compared to the previous week. The bears successfully neutralised several attempts to cross the $3.36 trillion mark, which weakened the participants’ sentiment and led to the return of capitalisation to the $3.24 trillion level. The area down to $3 trillion could be an easy target for the bears, as the market may need a tactical pause to consolidate its strength.

The Cryptocurrency Market Sentiment Index stabilised over the weekend at 74, close to extreme greed territory and the highest values since late January. These readings leave room for growth for both the sentiment index and prices.

Bitcoin hit the $107K level on Monday morning, triggering an intensified sell-off and quickly pulling back below $102K. During the European session, BTC stabilised around $103K, close to the average level of the last 10 days ($103.4K). A failed growth attempt could lead to a short-term pullback to $97K.

News Background

Significant inflows into spot bitcoin ETFs in the US have continued for four consecutive weeks. According to SoSoValue, net inflows into spot BTC-ETFs totalled $603.7 million over the past week, the lowest in eight weeks. Cumulative inflows since bitcoin-ETFs were approved in January 2024 totalled $41.77 billion, while net inflows into ETH-ETFs totalled $41.6 million last week, rising to $2.51 billion since July 2024.

HTX Research noted that lower US inflation and increased institutional participation support the current rally in the cryptocurrency market. Nevertheless, when key technical support levels are broken, the current consolidation may lead to a local correction.

JPMorgan believes that Bitcoin is likely to outperform gold in the second half of the year, thanks to corporate buying and growing support from US states. The shift in sentiment has already been evident in the past three weeks, with capital shifting from precious metals ETFs to spot BTC-ETFs.

According to the Fireblocks survey, 90% of banks, financial institutions, fintech companies and payment services plan to use or are already using stablecoins, focusing primarily on cross-border payments. Among the advantages mentioned by respondents, the first place is occupied by faster settlements.

The FxPro Analyst Team