Market Overview

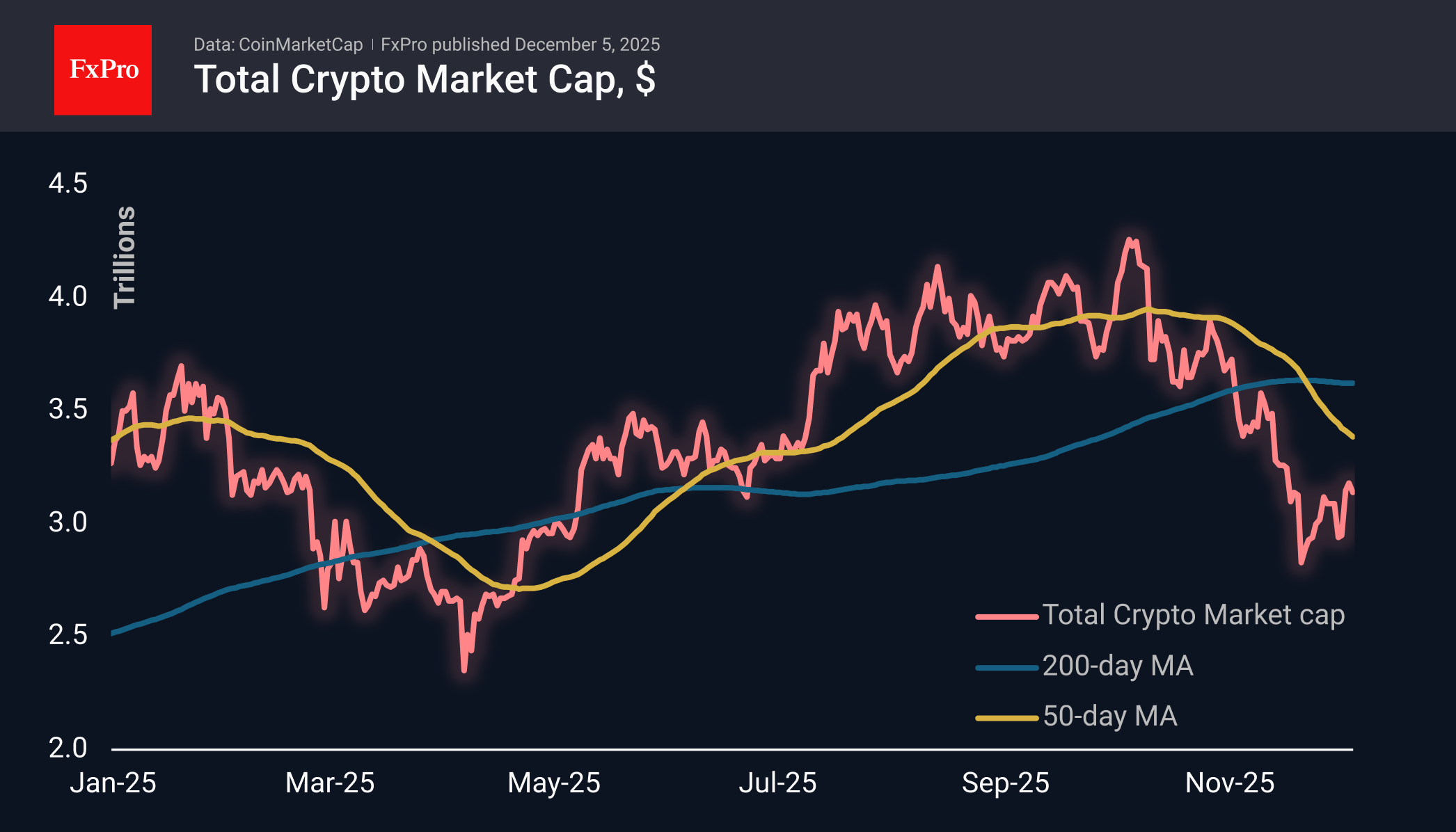

The crypto market capitalisation fell by 1% to $3.14 trillion over the past 24 hours, retreating from local highs but maintaining a relatively optimistic mood. Among the popular coins for the day, Zcash is once again in the lead, adding 10% and exceeding $400, while XRP loses 3.6% to $2.09. However, we still classify this as a rebound from oversold conditions, with doubts about the ability to renew October highs in the next couple of years. We also saw attempts to push the market up at the end of 2017 and in 2021. The capitalisation of the crypto market reached new highs during these pre-New Year rallies, but this is a dangerous game in which one needs to choose instruments more carefully than usual.

Bitcoin’s recovery slowed down, facing resistance from sellers in the $ 94,000 range. However, we view this as a pause rather than an exhaustion of the corrective rebound, which may well develop into the $98-100K range in the next few days. Nevertheless, we adhere to the 4-year cycle pattern, as the opposite has not yet been proven. In addition, we have seen a significant pullback from the highs of the previous two months, which is consistent with what happened in 2013, 2017 and 2021.

News Background

The Bull Score index developed by CryptoQuant fell to zero for the first time since January 2022, signalling a bearish market phase. CryptoQuant acknowledges that next year, Bitcoin is expected to fall to the $55K-$70K range.

Most of Bitcoin’s on-chain indicators are bearish, notes CryptoQuant CEO Ki Young Ju. According to him, without an influx of liquidity, the crypto market will enter a bearish phase of the crypto cycle.

K33 draws attention to several emerging medium-term factors that could form the basis for market growth. By February 2026, US regulators are expected to issue new rules for 401(k) retirement savings, which could potentially open up a $9 trillion market for Bitcoin.

Ethereum developers have successfully activated the Fusaka hard fork on the ETH mainnet. The update is designed to implement fundamental improvements to increase the scalability, efficiency and security of the Ethereum network.

BlackRock has announced the transformation of the financial system, influenced by cryptocurrencies and the growth of US public debt. Stablecoins are increasingly being used for cross-border payments and have become a bridge between the digital and traditional economies.

The FxPro Analyst Team