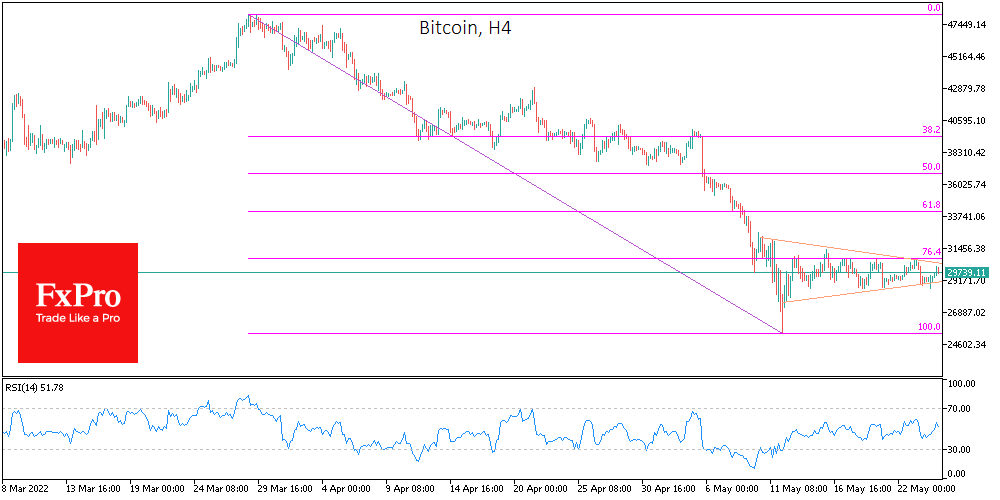

Bitcoin’s fluctuations continue to shrink, meaning the spring is being compressed further. The lower bound of the trading range has moved to $29K, from where the BTCUSD has received support since the start of active trading in New York. The upper bound of the formed triangle has moved to $30.5K against current prices at $30.0K, reflecting a 1.8% gain over the past 24 hours.

Ethereum has added 0.3% in the past 24 hours, with other altcoins in the top 10 from a 2.9% decline (Avalanche) to a 1.0% rise (BNB), but all faring worse than the crypto flagship.

Total coin capitalisation, according to CoinMarketCap, rose 1.1% to $1.28 trillion, with the Bitcoin Dominance Index up 0.4% to 44.7%. The Cryptocurrency Fear and Greed Index was down 1 point to 11 by Wednesday and remains in “extreme fear”.

The bitcoin price is in consolidation mode, equally dangerous for both bulls and bears. Both gain liquidity over time and get used to the current prices.

On the market cycle side, the chances are higher than the current consolidation will culminate in a breakdown of the lower boundary and liquidation of stop orders, reinforcing the initial downside momentum.

Behind the pessimistic outlook is a tightening of monetary policy with slowing economic growth, which puts retail investors in the mode of withdrawing capital from cryptocurrency in favour of consumption. It does not help that the expectations of getting rich fast through cryptocurrencies are not paying off, as bitcoin is worth as much now as it was in early 2021.

Investing in the industry is becoming more professional, moving beyond naïve attempts to buy and hold. According to CoinShares, investors are withdrawing money from bitcoin and investing in blockchains that support smart contracts, such as Cardano and Polkadot. Net capital outflows from crypto funds last week amounted to $141m.

The ECB warned that the high correlation between cryptocurrency and stock markets is usually seen in times of dire economic conditions and will no longer allow the diversification of investment portfolios with digital assets.

The FxPro Analyst Team