Market picture

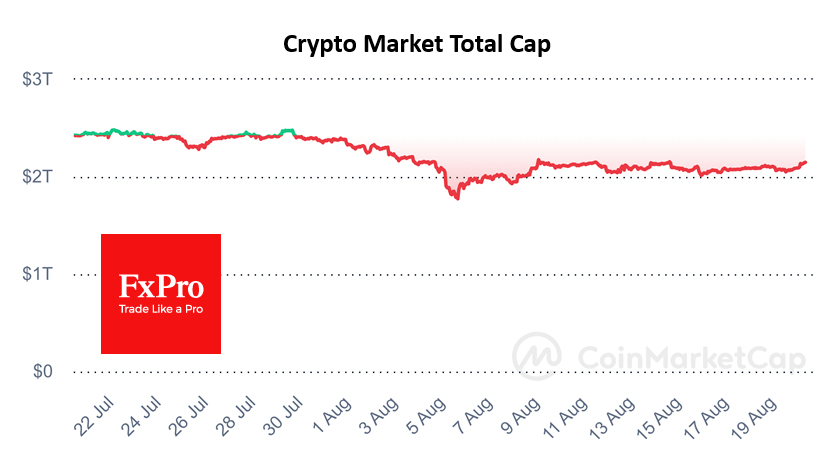

The cryptocurrency market is once again testing the important $2.15 trillion milestone, adding almost 4% in the last 24 hours. Selling pressure has been building near this level since early August. Now, thanks to the impressive recovery in stock indices, cryptocurrency buyers may feel more confident.

Bitcoin, having added 3.2% since the start of the day and around 4.5% in 24 hours, has once again come close to testing its 50-day moving average, trading just below $61.0K. Overcoming this resistance, from where Bitcoin has been selling off since 9 August, would take it to a test of its 200-day MA near $62.7K. A consolidation above these levels could dramatically improve sentiment in the entire cryptocurrency market and inspire more active buying.

Solana is trading below its 50- and 200-day MAs and near the lower end of its trading range, squeezed by news of the SEC’s doubts about its security status. This reverses the chances that an ETF based on it will be approved soon. Technically, a consolidation under $130 will be an important signal of buyers’ capitulation.

News background

According to CoinShares, crypto fund investments rose by a paltry $30 million last week, following inflows of $176 million the week before. Bitcoin investments rose by $42 million, Ethereum by $4 million, while Solana was hit by a massive outflow of $39 million.

CoinShares noted that Solana is facing its largest outflow of funds amid a sharp decline in trading of the meme coins on which it relies heavily.

BlackRock’s cryptocurrency ETFs have outperformed Grayscale’s products in terms of total assets under management, according to Arkham Intelligence. Just two of BlackRock’s funds – IBIT and ETHA – reached $21.21 billion in AUM, making the largest asset manager the industry leader.

Investment firm Franklin Templeton has filed a Form S-1 with the SEC to launch the Franklin Crypto Index ETF, a combined bitcoin and Ethereum-based exchange-traded fund. Subject to regulatory approval, the firm may add other cryptocurrencies to the product in the future.

Despite Bitcoin falling by a third from its all-time high to its low on 5 August, 74% of coins have not sold or moved in the past six months, according to Glassnode. The holding trend is reducing the available supply, which will lead to higher prices as demand increases.

The Federal Reserve Board of Governors and the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) have proposed amendments to the US Bank Secrecy Act to expand the definition of “money” to include cryptocurrencies and digital assets.

VanEck estimates that Bitcoin miners could generate about $13.9 billion in additional annual revenue by 2027 by shifting 20% of their energy capacity to the AI and high-performance computing sector.

The FxPro Analyst Team