Market Picture

The crypto market lost 1.7% of its cap in 24 hours to $2.24 trillion. The market is correcting as Trump’s chances of winning national polls diminish ahead of the election. For now, it looks like a de-risking ahead of an important event where both major candidates have roughly equal chances of winning.

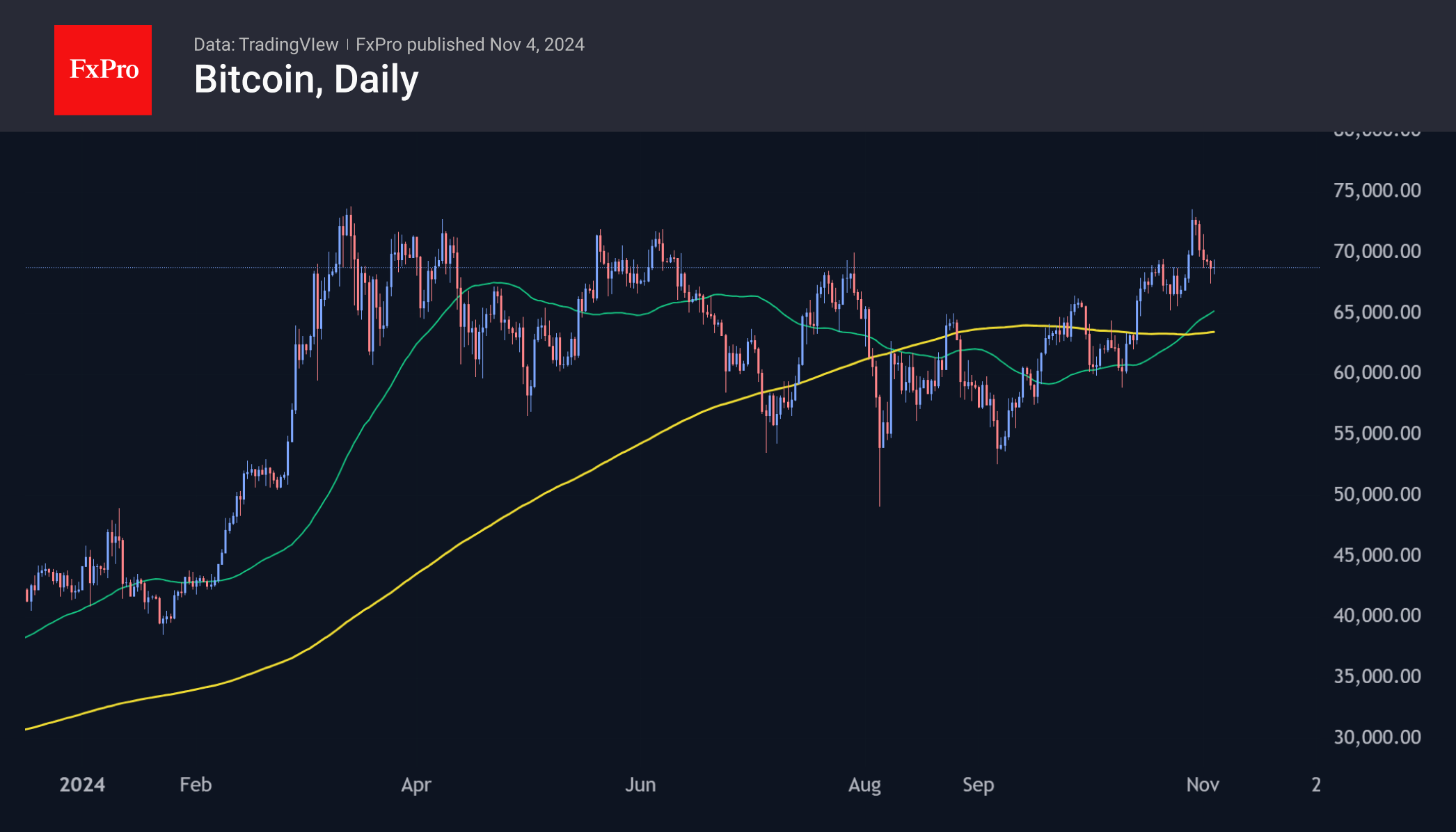

The price of bitcoin has fallen back below $68.5K and was bottomed out at levels $1K lower on Sunday. The pullback has not yet broken the overall bullish pattern that has been forming since September. We will be able to talk about the bears’ clear superiority when the price breaks below $65K, which would be a failure below the local lows from the end of last month and the 50-day moving average.

The situation is gloomier for Ethereum, which has been losing for the fifth day in a row, falling back to $2450—the lowest of the last three weeks. It is below the 50-day moving average and generally near the lower end of its trading range since August.

News Background

Inflows into spot bitcoin ETFs in the US were the highest since mid-March and the fourth highest since the funds’ inception. According to data from SoSoValue, inflows into BTC ETFs totalled $2.22 billion last week, bringing total investment to $24.15 billion.

Bitcoin options traders prepared for a bullish scenario after the US presidential election and the Fed meeting by increasing open interest in November calls with strike prices above $80K. JPMorgan noted that a Trump victory in the election on 5 November may strengthen BTC’s upward momentum.

Swiss company 21Shares has filed a Form S-1 with the US SEC to register an ETF based on XRP.

Tether, the issuer of the USDT stablecoin, reported a net profit of $2.5bn for the third quarter. Since the beginning of the year, the figure has reached $7.7 billion. According to Tether’s statement, the financial results have been confirmed by the auditing firm BDO. The group’s equity reached $14.7 billion, and consolidated assets reached an all-time high of $134.4 billion.

The state of Florida reported $800 million in cryptocurrency-related assets. It is not the first US state to invest in crypto assets. In May, the Wisconsin Investment Board announced the purchase of $163 million worth of spot bitcoin ETF shares.

The FxPro Analyst Team