Market picture

The crypto market has added another 1% to its capitalisation in 24 hours to $2.71 trillion, with an impressive pullback since the start of the day on Tuesday after some altcoins surged the day before.

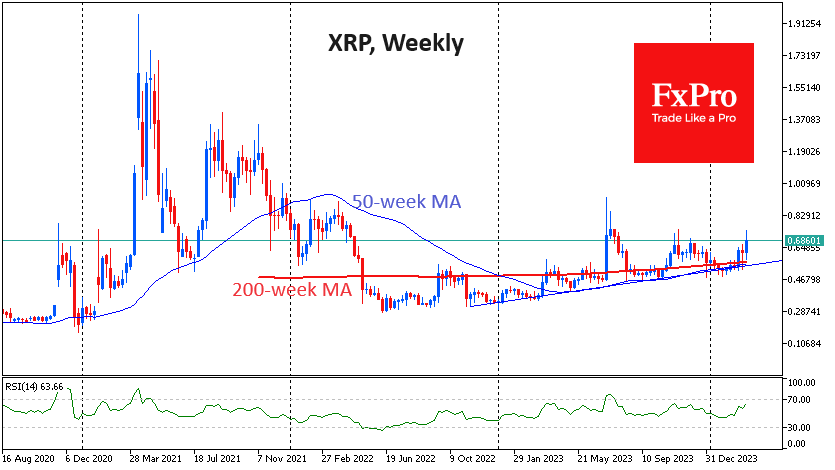

XRP is down 5% so far today after surging more than 20% on Monday evening. Litecoin saw similar momentum. These are all the stars of crypto bull rally of 2017. Their gains here are impressive only if you don’t consider that their prices are a modest quarter of their previous highs and that trading volumes and investor interest have fallen catastrophically. They have been relegated to the category of laggards in this volatile market, but that doesn’t negate their ability to grow. Prices of $200 for Litecoin and $1.3 for XRP are achievable within the current bull cycle.

According to CoinShares, investments in crypto funds rose by a record $2.685 billion last week, beating the previous record set three weeks earlier. Investments in Bitcoin increased by $2.637 billion, while investments in Solana increased by $24 million, and Ethereum decreased by $2 million. Investments in funds that allow bitcoin shorts increased by $11 million.

Rising prices pushed total assets under management to a record high of $94.4 billion, up 14% for the week and 88% YTD.

News background

Bitcoin climbed to eighth place on the list of the world’s largest assets overtaking silver by market capitalisation.

Representatives from Grayscale and Coinbase have discussed with the SEC the conversion of Grayscale’s Ethereum Trust into a spot ETF. The SEC representatives were not enthusiastic about the discussion. Bloomberg and FOX Business saw this as reducing the likelihood of product approval in May.

MicroStrategy also bought 12,000 BTCs at an average price of $68,477, according to founder Michael Saylor. The purchase was funded by a convertible bond issue due in 2030. MicroStrategy now owns 205,000 BTCs worth about $6.91 billion (average price $33,706).

Former US President Donald Trump has said he has no plans to discourage the use of Bitcoin or other cryptocurrencies if he wins the election in November. In his words, “It’s an additional form of currency”.

In the second quarter of 2024, the London Stock Exchange (LSE) will begin accepting applications to list Bitcoin and Ethereum-based exchange-traded notes (ETNs). Crypto ETNs will only be available to professional investors.

Increased activity on the Ethereum network amid the meme-coin frenzy has pushed fees to a two-year high, IntoTheBlock noted. The average transaction fee on the ETH network last week was $28.

The FxPro Analyst Team