Market picture

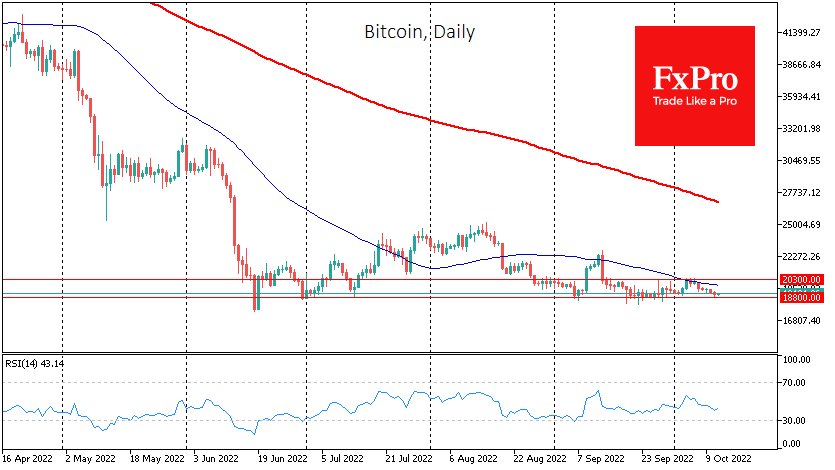

Bitcoin has changed little overnight, remaining near $19.1K amid a decline in stock indices. The first cryptocurrency continues to test the horizontal support of the past four months, as the Nasdaq100 updated its June lows and slipped to the lows of two years ago.

Total cryptocurrency market capitalisation rose 0.4% over the past 24 hours to 922bn, with the top altcoins ranging from -0.8% (Cardano) to +2% (Dogecoin). The Cryptocurrency Fear and Greed Index was down 4 points to 20 by Wednesday and remains in a state of “extreme fear”.

The daily charts show bitcoin sliding down over the past week. Still, the primary battle between bulls and bears appears to be waiting for us to fall to the $18.8K area, with the main question being whether the bulls had enough to confirm impassable support in that area.

News background

Glassnode said Bitcoin is close to completing a bear market, based on an analysis of behavioural patterns, market structure and on-chain indicators. But it may take a few more months for the current phase of the market to end.

A bearish trend in the market is the best time to profit, suggests Hunter Horsley, CEO of index fund Bitwise. If the market continues its historical trend of 4-year cycles, bitcoin will enter a new growth cycle in 2024.

Google with Coinbase collaboration will allow some customers to pay for cloud services with cryptocurrencies.

Portugal plans to introduce a standard 28% tax on profits from cryptocurrencies generated in 2023. The initiative aims to equate the cryptocurrency industry with others and lay the groundwork for the industry’s future.

Meanwhile, Ripple announced the launch of an On-Demand Liquidity (ODL) treasury solution in France and Sweden. Partners are payment services Lemonway and Xbaht.

The FxPro Analyst Team