Market picture

Bitcoin attempted to climb out of the hole during the week, adding 6.5% to 17250 on Monday morning. Ethereum adds 10% to $1290. Other leading altcoins in the top 10 changed from -0.2% (BNB) to +14.5% (Litecoin).

Total crypto market capitalisation, according to CoinMarketCap, was up 5.9% for the week, to $867bn. The cryptocurrency Fear & Greed Index was unchanged for the week, remaining at 26 points (‘fear’).

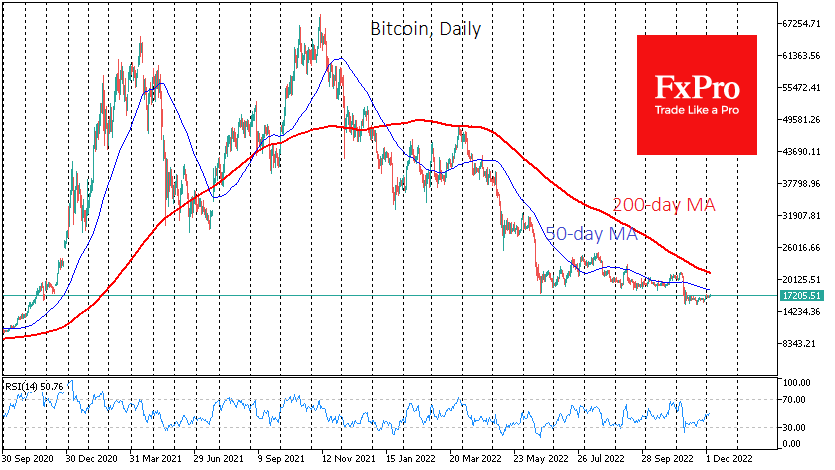

Although Bitcoin’s exchange rate has been the highest in the last three weeks, the history of recent months has restrained optimism, as we have seen a smooth rise followed by a precipitous fall more than once.

The 50-day moving average, which used to be a reliable trend indicator in 2020, gave several false bullish signals since this July. Therefore, it makes sense for longer-term speculators to look for the series of local highs. So far, each new local high is lower than the previous one. The latest local high is near the 22K, close to the 200-day MA. Probably only a new, higher high will be a reliable, albeit relatively lagging signal of a trend change.

News background

James Gorman, CEO of Morgan Stanley, one of the world’s largest banks, said he was “glad he didn’t buy bitcoin for $60,000”. He said he refrains from investing in digital assets because of the high level of risk and unpredictability.

Tether, the issuer of the USDT stablecoin, denied The Wall Street Journal’s (WSJ) accusations of issuing unsecured loans, saying that the WSJ’s concerns about Tether setting the stage for a global crypto industry crisis were not well-founded.

Opera developers have announced a partnership with the Alteon LaunchPad platform. Through the partnership, browser users can issue non-interchangeable tokens quickly and cheaply.

The FxPro Analyst Team