The crypto market has again surpassed $2 trillion, adding almost 2.7% in the last 24 hours. Bitcoin, meanwhile, has not kept pace with the rise in altcoin prices: BTC strengthened by 1.45% against a 4% rise in ETH, while other leading coins added between 3% and 7%.

The purchase of altcoins has intensified after the first cryptocurrency defended the $40K mark. This was like a sign of faith in the sector’s short-term prospects, which again allowed enthusiasts to invest in potentially more undervalued coins and projects.

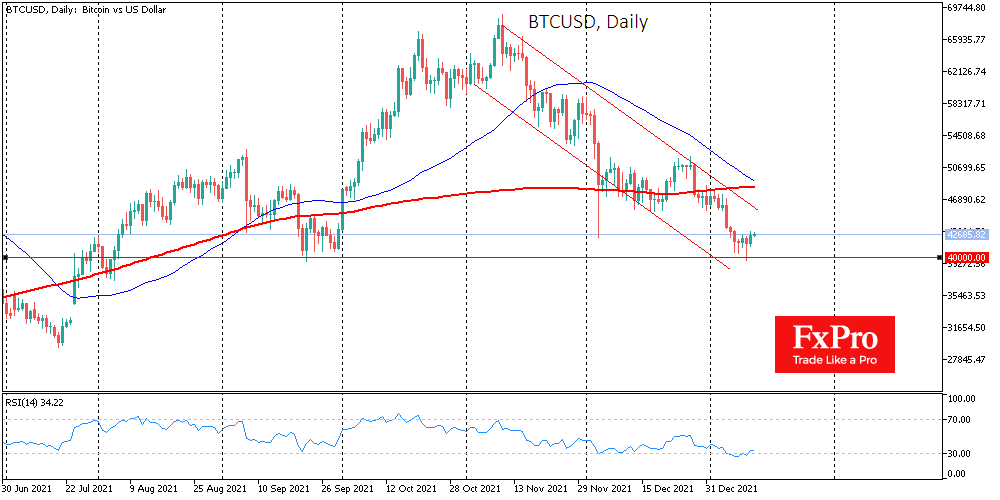

The crypto Fear and Greed Index added 1 point to 22 overnight, but we can see that investors took the recent plunge as a buying opportunity. On the chart, bitcoin rebounded from a psychologically important support level for the second time since September. In addition, the RSI indicator on the daily charts came out of the oversold area, signalling a pause in the bearish momentum.

However, it is too early to say that we are seeing the beginning of a new growth wave. There are several reasons for that.

In this wave of decline, the RSI indicator reached lower lows than earlier in December and markedly lower levels in September and July, marking more persistent and prolonged selling than in previous episodes.

Bitcoin’s consolidation attempts this week is only a wobble near the bottom. A bullish reversal will be indicated by solid upward momentum in July or September. The mini rebound in December was quickly eaten away by the bears.

BTCUSD is consolidating near the lower boundary of the descending channel. To say that we see more than just a bounce within this trend is only possible if it grew above 45k – where the previous local lows and the downside resistance line are concentrated.

If bitcoin fails to develop an uptrend, it will seriously spoil sentiment for cryptocurrency traders, creating a toxic environment in the sector and putting selling back on the agenda, despite the prospects of individual projects.

The FxPro Analyst Team