Market Picture

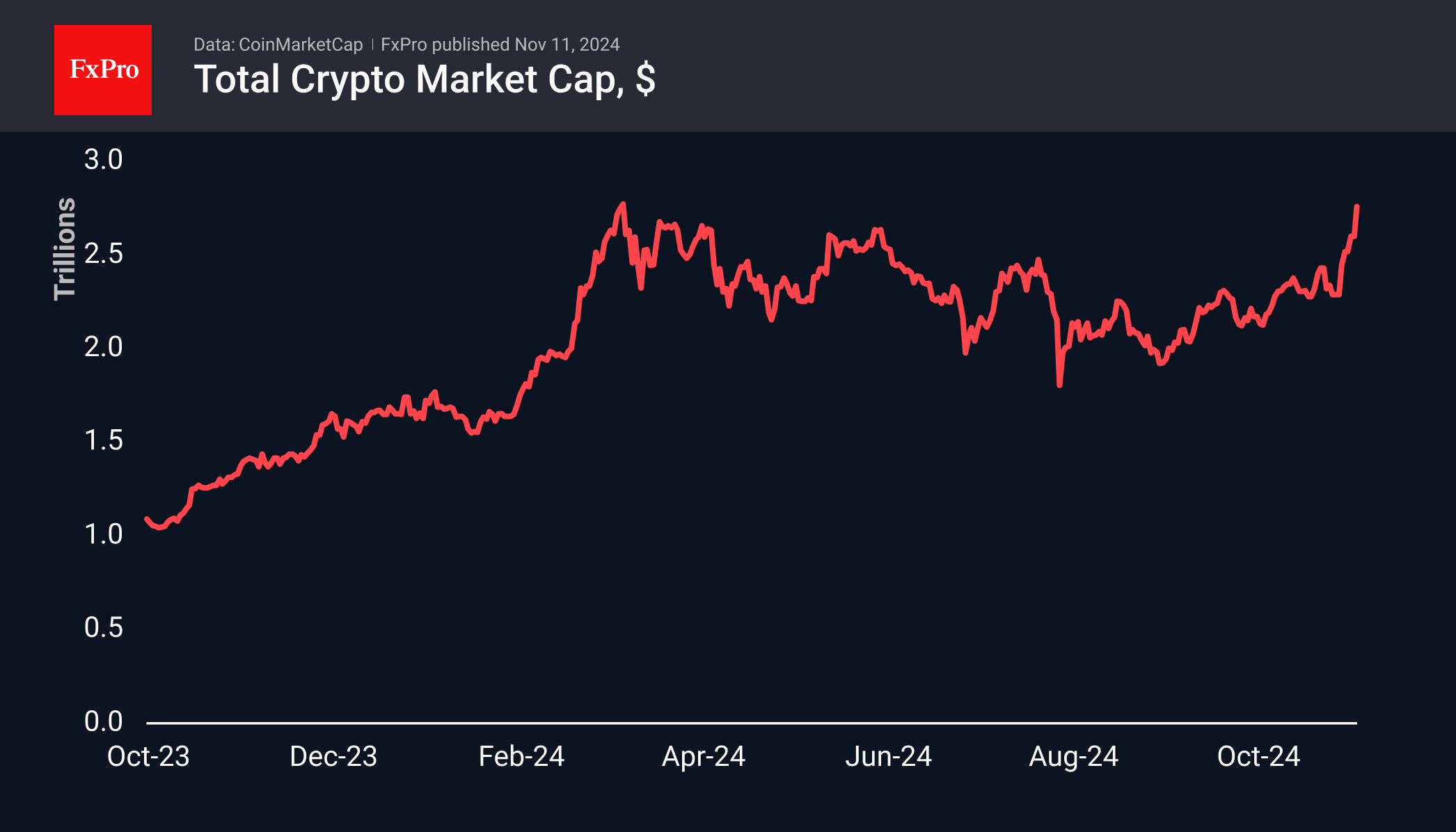

The crypto market capitalisation has reached $2.75 trillion, approaching the peak of $2.77 trillion reached in March this year. The next target for the crypto bulls looks to be the historical highs at $2.86 trillion and possibly even the next round level of $3.0 trillion.

Bitcoin has broken the upper boundary of the ascending channel, accelerating the renewal of historical highs. A key technical target and next milestone now appears to be the $100-110K area, as the five-month drift down from $73K to $50K looks like a correction of the bullish momentum from September 2023 to March 2024. The breakout to new highs confirmed the extension of the bullish momentum, making the 161.8% level the next target. Next, the $100-110K area should be ready for a major shakeout as many will be looking to take profits after impressive gains and on reaching key round levels.

Bitcoin is attracting attention with its all-time highs and weight in the crypto market. However, altcoins such as Dogecoin and Cardano, although far from their highs, more than doubled in value in the 5 days following Trump’s victory before correcting late on Sunday. Although both coins look overbought on daily timeframes, they are being driven by FOMO and short squeeze, which promises more chaotic moves in the coming days. Perhaps now is the time to pick up altcoins, which have so far shown growth rates averaging between Bitcoin and Dogecoin.

News Background

From a fundamental perspective, Bitcoin shows no signs of overheating. Galaxy Digital notes the lack of a spike in funding costs for perpetual contracts and a moderate increase in open interest (OI) for cryptocurrencies in general.

According to Fundstrat co-founder Tom Lee, Bitcoin prices will rise to “six figures” before the end of the year. He believes the likely reason for the interest in BTC is its potential as a reserve asset. Trump has previously promised to create a national Bitcoin reserve.

Technical analyst Peter Brandt commented on the optimal time to buy Bitcoin. According to him, the asset will rise another 73-100% and form a cycle top in August or September 2025.

The US SEC has postponed a decision on the NYSE’s proposal to list options-based spot Ethereum ETFs. The NYSE requested this from the SEC on August 7th.

Tether’s investment arm has funded a $45 million USDT crude oil deal that is “the first of its kind” and provides new lending opportunities in various areas, the company said.

The Ethereum Foundation (EF) reported $970 million in cash reserves, which includes liquid and vesting allocations. In 2022-2023, startups in the Ethereum ecosystem received $497 million in funding, according to the EF report.

The FxPro Analyst Team