Market Overview

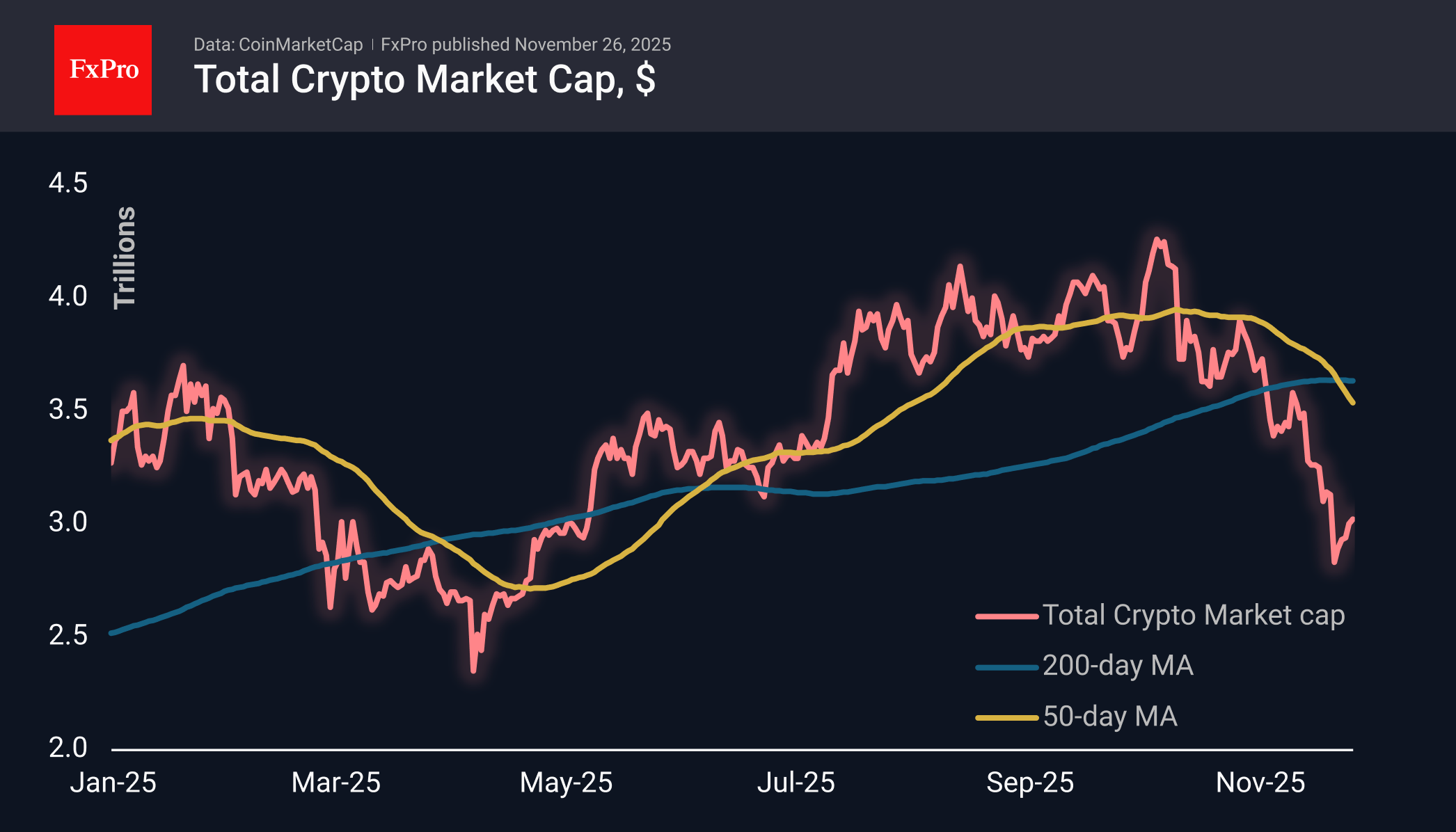

The crypto market cap rose 0.6% to $3.02T, continuing its retreat from the local low reached on Friday. Once again, the stock market pulled cryptocurrencies up, but this time the positive sentiment was only enough for a slight increase to the level of 24 hours ago, with a decline at the end of Tuesday.

Bitcoin has been trading around $87K for the last three days. The recovery rebound has lost momentum, but the bears have not taken active action either, due to increased risk appetite in global markets and a moderate weakening of the dollar, which is an ideal breeding ground for cryptocurrencies. We continue to note the weakness of cryptos, given the favourable investment environment, which forces us to look for reasons in longer-term processes, such as profit-taking after the rapid growth of the last two years.

News Background

The fall in Bitcoin is linked to the reaction of institutional investors on Wall Street, who were unprepared for the sharp fluctuations in the asset, said Anthony Pompliano, founder of Pomp Investments. The situation is exacerbated by the end of the year: fund managers are concerned about bonuses and are selling assets they have begun to doubt.

According to CryptoQuant, Bitcoin’s risk-return ratio has become the most attractive since mid-2023. This does not guarantee that the bottom has been reached, but it does indicate high potential in the future.

In the first quarter of 2026, the first cryptocurrency may remain in the $82K-$90K range without sharp volatility, Citigroup bank suggested. After the October collapse of cryptocurrencies, investors’ appetite for risk has sharply declined.

According to The Block Data, the ratio of long and short positions on Bitcoin among major players on Binance exceeded 3.8, the highest figure in more than three years.

JPMorgan has opened sales of Strategy (MSTR) shares, according to TV presenter Max Keiser, but there has been no official confirmation of this. In October, the bank announced the risks of MSTR being excluded from key MSCI stock indices, which could lead to an outflow of $2.8 billion.

According to Cointab, 73% of public companies that have invested in Bitcoin have liquidity problems, and 39% have liabilities that exceed the value of their accumulated crypto assets.

The FxPro Analyst Team