Market picture

Bitcoin rose 2.6% to $22,300 in the past 24 hours amid rising stock indices and a weaker US dollar. Ethereum lags the market, losing 0.7% to $1715. Top altcoins performance ranged from -1.5% (Cardano) to +10% (Solana).

Total crypto market capitalisation, according to CoinMarketCap, rose 1% overnight to $1.06 trillion. The cryptocurrency Fear & Greed Index added 9 points to 34 by Tuesday, the highest since mid-August.

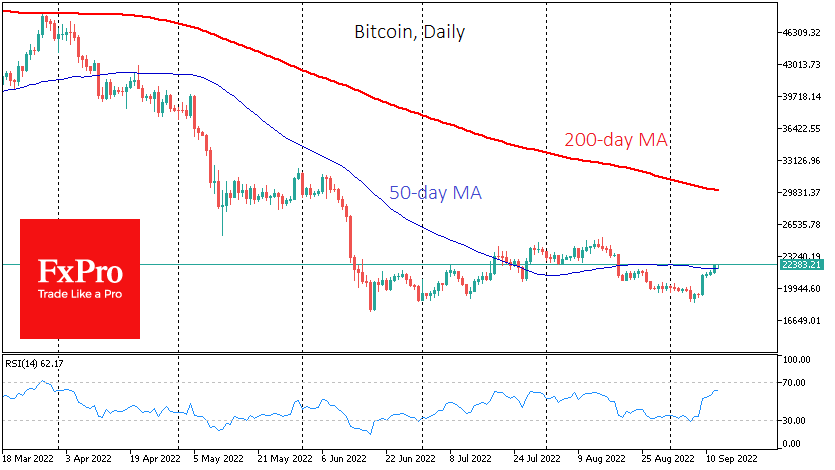

BTC is just a hair above its 50-day average, which should hardly be considered an encouraging bullish sign. The following intermediate stage of recovery that could revive the market is the 200-week average at $23.2K.

The latter dynamic suggests cautious market players, who are likely to shift their attention to global macro issues. The most critical of these today is the US inflation report, which could return optimism to the markets if price growth slows and sell-offs otherwise. TradingView shows a correlation between bitcoin and the S&P 500 index started to strengthen again last week.

Solana posted the highest daily gain among top coins. Despite the overall market decline, the number of NFTs issued on the Solana blockchain rose sharply, reaching 312K. The trading volumes of collectable assets on the network have also jumped.

News background

According to CoinShares, crypto funds saw a $63 million outflow last week, the highest in 12 weeks. Ethereum funds lost $62M, bitcoin funds – $13M, and short-BTC funds got an $11M inflow. These dynamics starkly contrast to the price behaviour and overall market capitalisation, showing that the institutions are not setting the prices here.

The bitcoin network’s hash rate has renewed its all-time high of 281.79 million TerraHash, shifting the projected date of the next halving from May 2024 to Q4 2023.

According to a Harris Poll survey, 70% of cryptocurrency investors are hoping to become billionaires, which is significantly above the number among traditional investors.

On September 19, due to increased regulatory pressure, Huobi will delist seven anonymous cryptocurrencies, including Dash (DSH), Monero (XMR) and Zcash (ZEC).

The FxPro Analyst Team