Market Picture

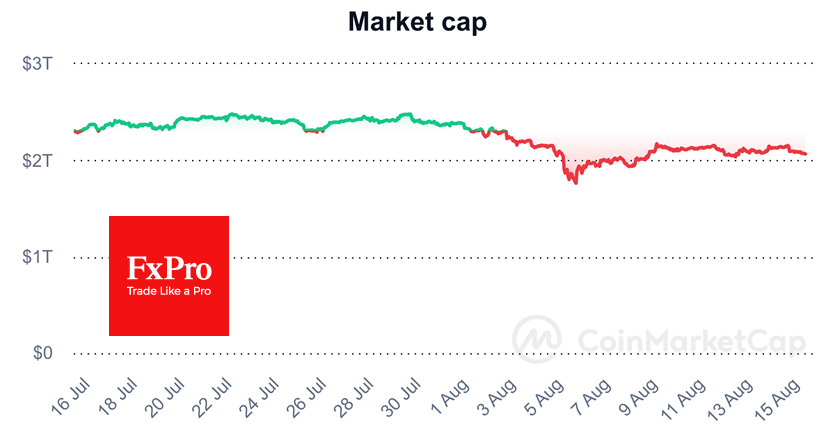

The cryptocurrency market retreated 2.9% over the past 24 hours to $2.08 trillion from levels near $2.15 trillion, which had been resistance for the past ten days. Despite moderate optimism in equities following the inflation data, cryptocurrencies failed to find sufficient demand. The negative performance of cryptocurrencies could herald another round of outflows from risk assets, especially ahead of the weekend.

Bitcoin fell to $58K, a loss of 4.5% in 24 hours. The sell-off started with the crossing of the 50- and 200-day moving averages. According to statistics, when a ‘death cross’ is formed, it takes an average of one month to recover to the starting point.

Ethereum, which rolled back to $2620, experienced a similar drop. The rally lost momentum near the 61.8% level of the initial decline, creating the risk of another $500 pullback.

News Background

Cointelegraph writes that Solana’s (SOL) rise to $190 looks more realistic than $300-1000 due to competition from L2 for Ethereum and the risks of waning hype around meme coins. The journalists called SOL overvalued compared to L2 tokens for Ethereum.

Former employees of the TON Foundation have set up a venture capital firm, TON Ventures, and raised an initial investment of $40 million. The project will support startups on The Open Network (TON). The TON cryptocurrency hit new highs in more than three weeks, climbing above $7 intraday.

Rising stablecoin issuance could be the key to Bitcoin’s continued rally, according to 10x Research. The issuers of the largest stablecoins, Tether and Circle, issued nearly $2.8 billion worth of assets last week, indicating that some institutional investors are injecting fresh capital into the crypto market.

According to SEC filings, investment bank Goldman Sachs and trading firm DRW Holdings own crypto ETFs worth $418.7 million and $238.6 million, respectively.

According to Growthepie, the daily number of transactions in Ethereum-based Layer 2 (L2) solutions has reached a record 12.5 million, up more than 140% since the beginning of the year. The Coinbase-backed Base blockchain has largely driven the growth. At the same time, the number of active addresses in the L2 segment began to decline, peaking in mid-July.

According to Token Terminal, BlackRock is preparing to launch its blockchain, which will be an analogue of Coinbase’s L2 network.

The FxPro Analyst Team