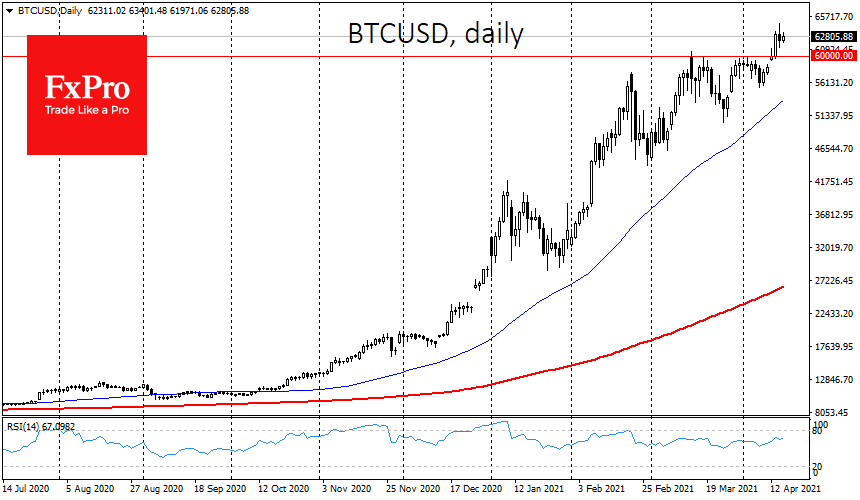

Bitcoin, which has received attention from corporations, funds, media personalities, payment systems, and sometimes passionate retail investors, has been relentlessly updating historic highs. Yesterday, the coin nearly touched $65K before facing a correction, and Thursday morning shows zero price movement for the day, trading around $63,200. It’s hard to call that a bad result, as it wasn’t long ago that bulls and bears were playing tug-of-war around the $60K threshold level.

The direct listing of Coinbase shares on the Nasdaq exchange was very successful, bringing the capitalization of the exchange to $105 billion at one point. Thus, the leading cryptocurrency exchange has also become the largest exchange on the planet. It is hard to underestimate the value of what happened. The American cryptocurrency exchange has shown that the cryptocurrency sector is increasingly entering the mainstream and will attract a large number of participants who previously did not consider cryptocurrencies to be an investment-worthy asset.

As the start of the direct listing approached, the crypto market showed impressive growth, reaching a total capitalization of $2.2 trillion. The Bitcoin dominance index fell to 52.9%, although this could fall much lower from the historical perspective.

The decline in this index is considered a healthy situation for the market as a whole. The altcoin season in early 2018 occurred in the background of weak Bitcoin dynamics, but now investors are interested in all crypto assets at once. Such a positive outcome was made possible by institutional interest in digital currencies.

Nevertheless, especially during periods of such active growth, it is worth remembering that big capital prefers major cryptocurrencies, and its optimism may not extend to all other coins, which mostly attract retail demand. Dogecoin, for example, showed an increase of more than 114% for the week, thanks to the rush of retail demand. The interest in the coin-meme should serve as a reminder that in the case of rapid correction, altcoins would face a sell-off that would be much more fierce than that of the major coins.

Analyst companies, including Glassnode, are starting to believe that miners have been deferring mined coins in anticipation of rising prices. A similar attitude is noted among bitcoin whales. However, one important final element of the strategy is missing – coins are put aside for later sale at a higher price. Compared to 2017, crypto market participants have a much less dreamy sentiment towards digital currencies. Still, as in 2017, the main goal is to maximize profits, which means that big capital will at some point begin to sell aggressively. The Coinbase listing is considered by many to be the final possible peak of the 2021 cryptocurrency bull rally.

The FxPro Analyst Team