Market Picture

Risk appetite played out in the markets on Thursday, adding over 6.4% to the crypto market’s capitalisation in the last 24 hours. The capitalisation peaked at $2.18 trillion in the morning, the highest since last Friday.

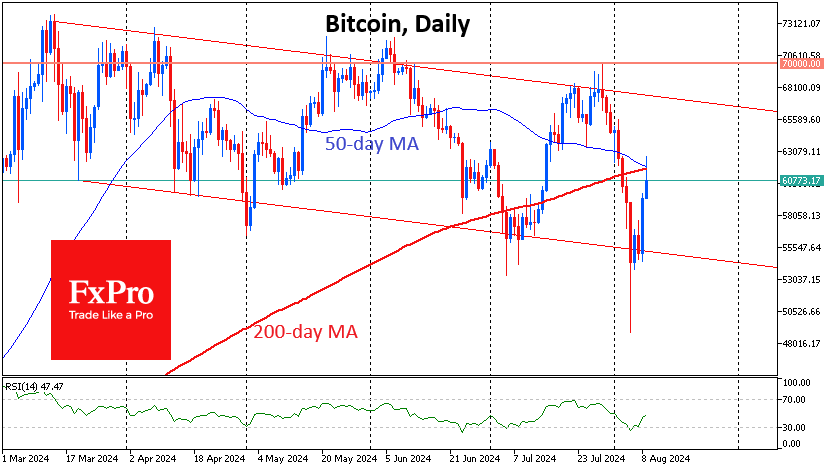

In just over 24 hours, the price of bitcoin rose 14% to $62.6K, before falling back to $60K by the start of active trading in Europe. The former cryptocurrency failed to break above the intersection of the 50- and 200-day moving averages. The ability to close above this at $61.8K could encourage buyers to quickly rally to $67K. A retreat from this level would set up a scenario of a return to the area of the sustained July and August lows near $55.5K.

Ethereum is trading at $2660, having rallied to a classic 61.8% Fibonacci retracement of the down amplitude from 22 July to 5 August. A death cross has formed on the daily chart, increasing the chances of a downward move under technical pressure. On the other hand, Ethereum is still oversold locally, and financial markets are rallying, attracting bargain hunters to the crypto.

News background

According to Santiment, bitcoin whales actively accumulated coins during the crypto market crash on 5-6 August. The number of transactions reached its highest level since April. According to CryptoQuant’s calculations, the balance of miners’ wallets was increased by 404,448 BTC ($23 billion) over the past 30 days.

Institutional investors have virtually not reduced their positions in the first cryptocurrency amid the turbulence, which has contributed to the rebound in prices, JPMorgan noted.

Major liquidations from the Mt. Gox and Genesis bankruptcies are behind us, and upcoming fiat payments to FTX creditors later this year could boost demand. Major US political parties are also signalling support for favourable cryptocurrency regulation.

The New York Stock Exchange (NYSE) has filed with the SEC to list and trade spot Ethereum ETFs from Bitwise and Grayscale.

Brazil’s Securities and Exchange Commission has approved the launch of the country’s first Solana-based exchange-traded fund (ETF) (SOL). However, Brazil’s B3 stock exchange still needs to approve the new investment product for trading.

The FxPro Analyst Team