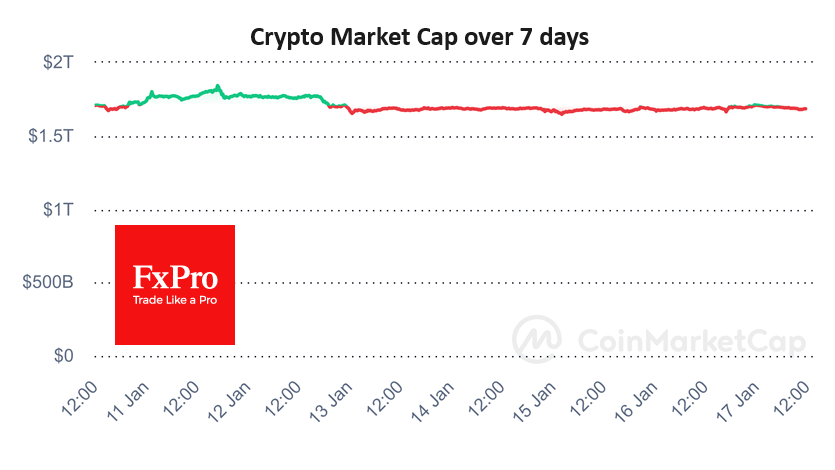

Market picture

The crypto market has been going around in circles since 13 January, staying near levels 24 hours ago, although Bitcoin’s intraday range exceeded 3.5%. Reaching the highs of the recent trading range triggered a methodical sell-off early on Wednesday and quickly spread to the major altcoins.

Bitcoin made local highs late on Tuesday, reaching $43.5K, but at the time of writing, it has already lost 1K. On daily timeframes, this still looks like a wander around the 50-day, leaving the bulls hoping that the level can be held. However, intraday dynamics instead point to methodical selling near local highs, while bounces are occurring sharply and with less volume. This is a cautionary observation but not at all a verdict on the cryptocurrency bull market.

Transaction volume on the Ethereum network has surged over the past week to levels seen in November 2021, when the asset was trading near all-time highs above $4600. At the same time, the supply volume is “on the upside” at 91.5%. Significant unrealised gains in the short term could serve as a bearish factor, putting pressure on ETH with a potential wave of selling.

News background

Spot bitcoin ETFs have opened a channel for significant capital to flow into the industry, but they have also created new risks, The Block writes. One of the apparent problems has been the concentration of storage of bitcoins owned by the funds. In addition, traditional financial practices have the potential to threaten the ecosystem of the first cryptocurrency.

Bitcoin, stablecoins and digital currencies of central banks, although still in the budding stage, offer opportunities to undermine the dollar’s domination, according to Morgan Stanley. The launch of spot bitcoin ETFs could greatly accelerate the process of de-dollarisation of the global economy.

International Monetary Fund’s Kristalina Georgieva said that cryptocurrencies are an asset class, not money, so Bitcoin is unlikely to displace the US dollar.

Stablecoin TrueUSD (TUSD) lost parity with the US dollar, falling 1.3% to $0.984. The de-peg came against a background of significant sales of TUSD on Binance.

Tether expressed disappointment with the UN’s assessment of the use of the USDT stablecoin in illegal activities and ignoring the asset’s role in emerging economies.

The FxPro Analyst Team