Technical analysis - Page 353

May 19, 2020

• EURNZD under bearish pressure • Likely to fall to 1.7695 EURNZD has been under bearish pressure after the price reversed down from the resistance zone lying between the resistance level 1.8270 (which has been reversing the price from the.

May 18, 2020

• WTI under bullish pressure • Likely to rise to 35.00 WTI has been under bullish pressure after the price broke the resistance zone located between the resistance level 29.17 (top of the previous waves 4 and (ii)) and the.

May 18, 2020

• NZDUSD reversed sharply from support zone • Likely to rise to .6145 NZDUSD today reversed up sharply from the support zone located between the key support level 0.5923 (which created two consecutive Morning Stars in April), lower daily Bollinger.

May 18, 2020

• EURCHF reversed from support area • Likely to rise to 1.0550 EURCHF today reversed up from the support zone located between the pivotal support level 1.0504 (which stopped the earlier downtrend in April) and the lower daily Bollinger band..

May 18, 2020

• NZDJPY reversed from support area • Likely to rise to 65.70 NZDJPY today reversed up from the support area lying between the support level 63.60 (lower boundary of the sideways price range from March), lower daily Bollinger band and.

May 15, 2020

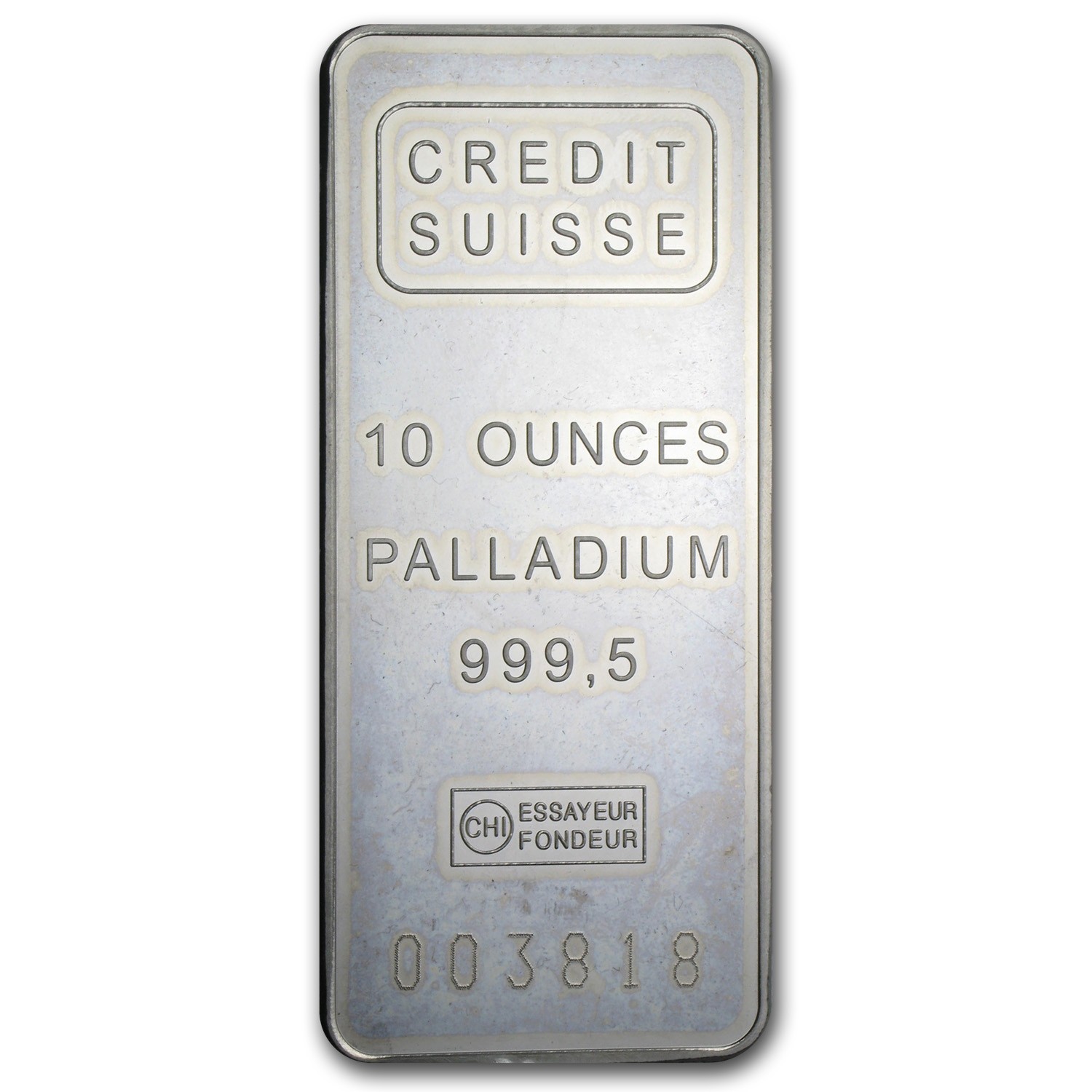

• Palladium reversed from support area • Likely to rise to 1900.00 Palladium recently reversed up from the support area lying between the support level 1741.00 (former monthly low form April), lower daily Bollinger band and the 61.8% Fibonacci correction.

May 15, 2020

• Silver broke resistance zone • Likely to rise to 17,00 Silver recently broke the resistance area lying between the resistance level 15.80 (monthly high from April) and the 61,8% Fibonacci correction of the previous downward impulse (3) from February..

May 15, 2020

• WTI broke resistance zone • Likely to rise to 31.77 WTI recently broke the resistance zone lying between the key resistance level 27.55 (top of the previous short–term impulse wave A) and the 38.2% Fibonacci correction of the previous.

May 15, 2020

• GBPCAD broke support zone • Likely to fall to 1.7000 GBPCAD recently broke the support zone lying between the key support level 1.7190 (monthly low from April) and the 50% Fibonacci correction of the previous upward impulse wave 1..

May 15, 2020

• Apple reversed from support area • Likely to rise to 320,00 Apple today reversed up from the support area lying between the support level 302.00 (former strong resistance from the start of March) and the 38.2% Fibonacci correction of.

May 14, 2020

• FedEx broke the support zone • Likely to fall to 100.00 FedEx recently broke the support zone lying between the key support level 107.50 (low of the previous correction B from April) and the 61.8% Fibonacci correction of the.