One by one, Dollar bulls beat out stops in one key currency pair, taking the US currency to multi-month highs. The dollar index climbed to a high of precisely one year, reaching 94.4 by advancing against its main rivals, the Euro and Yen. At the same time, the pressure on the Pound is still in place.

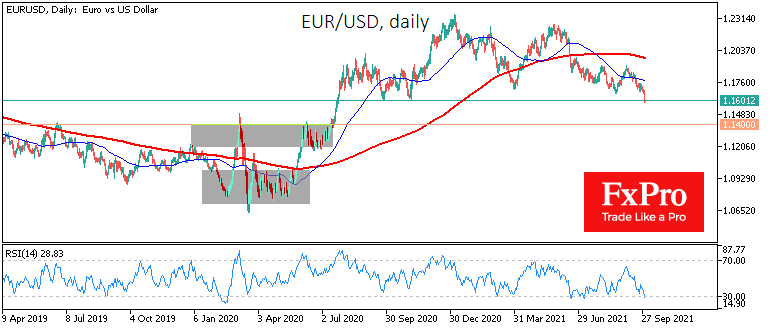

Over Wednesday, the Euro lost 0.8% against the Dollar, briefly falling under 1.1600, its lowest since July 2020. The decisive break of established ranges with a lower bound near 1.1700 indicates the seriousness of dollar buyers after a prolonged consolidation at 1.16–1.22 since the middle of last year. Lacking significant technical headwinds, the Euro may slide rather quickly towards 1.12–1.14, where we saw the previous tug-of-war between the bulls and the bears last June and July. The bears might aim at 1.07-1.10, which received methodical buyers’ demand at the beginning of last year.

The British Pound remained under increased pressure on Wednesday after a more than 1% plunge the day before. On Thursday morning, GBPUSD is trying to claw its way to levels near 1.3440. By pulling back to this level, sterling has given up half of its gains against the Dollar from last September’s rally to this year’s February and June peaks. However, a move out of the sustainable range opens a straight path for GBPUSD into the 1.3000 area over the next couple of months.

In addition, against the Japanese currency, the Dollar rose to 112 at one point. From these levels, the pair has repeatedly reversed to the downside since early 2019, trading higher for only a few hours. The chances of the bulls consolidating above that mark this time will be higher if the stock markets manage to separate the Dollar’s rise from the flight from risky assets.

Yesterday they did, and key US stock indices managed to claw their way into rising territory in a desperate attempt, despite a sharp strengthening of the Dollar – a scarce and shaky combination.

Apart from technical factors and the triggering of stop orders outside of established ranges, fundamentally, the Euro, Pound and yen are also under pressure from the softer stance of national central banks relative to the Fed.

In addition, in the eurozone, the UK and Japan, we expect import costs to rise sharply due to a jump in energy prices. This could also have a noticeable negative impact on business and consumer activity in the coming months, further pushing back the central bank’s policy normalisation plans. At the same time, the US imports energy to a much lesser extent and a jump in oil and gas prices promises to spur drilling activity.

The FxPro Analyst Team