Crude oil cleared the way to $100

October 05, 2021 @ 12:08 +03:00

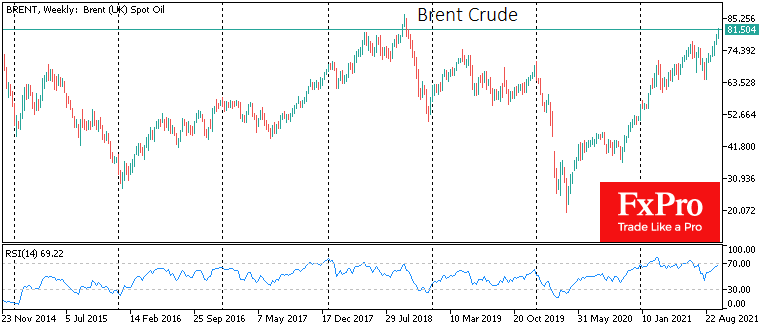

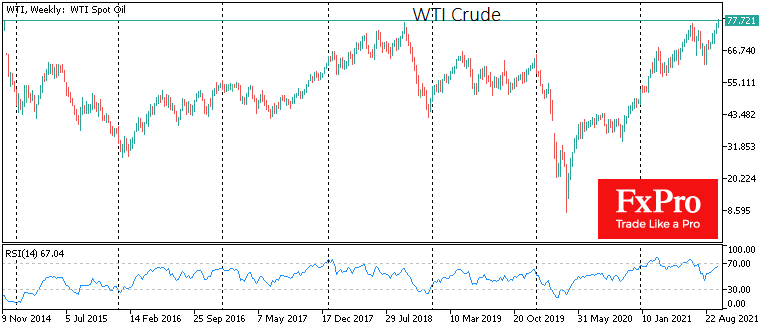

OPEC has not accepted calls to accelerate oil production quotas amid a rally in gas and coal prices in Europe and Asia, boosting oil prices. WTI prices renewed their 7-year highs, climbing above $78 at one point. The gains for Brent were slightly more modest, with Brent hitting just three-year highs of $82.

Oil prices have risen almost uninterruptedly over the past seven weeks, adding more than 25% over that period. That does not mean that the potential of the rally has been exhausted. Much of the latest rise has been a recovery from a deep correction. Oil has lagged noticeably behind gas and coal in its momentum and potentially has significant upside potential.

The reluctance of OPEC+ to accelerate its production recovery schedule supports interest in oil among buyers. The recent corrective pullback and a decisive break from previous highs tend to accompany further price rallies.

In 2014, WTI crude fell almost non-stop from the $100 area to $45. As a result, a lofty space between $75-100 has formed on the charts, where quotes may not encounter any meaningful upside resistance.

There is a little more noise in Brent quotations due to the October 2018 peak near $86. But except for this episode, the $80-100 area often acts as a transitory area, with significant turning points concentrated outside it.

Simply put, there are no significant obstacles on the Tech analysis side for oil to rally to the $100 area. The only thing which would stop it is major fundamental events. For example, buyers now should be aware of signals of a sharp slowdown of economic growth, which threatens a decline in energy consumption. However, more risks for oil are posed by threats from the world’s biggest central banks to tighten monetary policy more aggressively as inflation becomes more persistent.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks