The Australian Dollar fell to a one-year low on Tuesday after the release of the minutes from the latest Reserve Bank of Australia (RBA) monetary policy meeting and escalation of the trade war between US and China. The minutes from the RBA omitted a key statement saying that “members agreed that it was more likely that the next move in the cash rate would be up, rather than down” which implies a downgrade to the outlook on interest rates. This highlights the continuing policy divergence with the US Federal Reserve which will exert bearish pressure on the Aussie. Moreover, China is Australia’s largest trade partner which imports a majority of the nation’s iron ore output so the trade war is also a concern for the Australian economy.

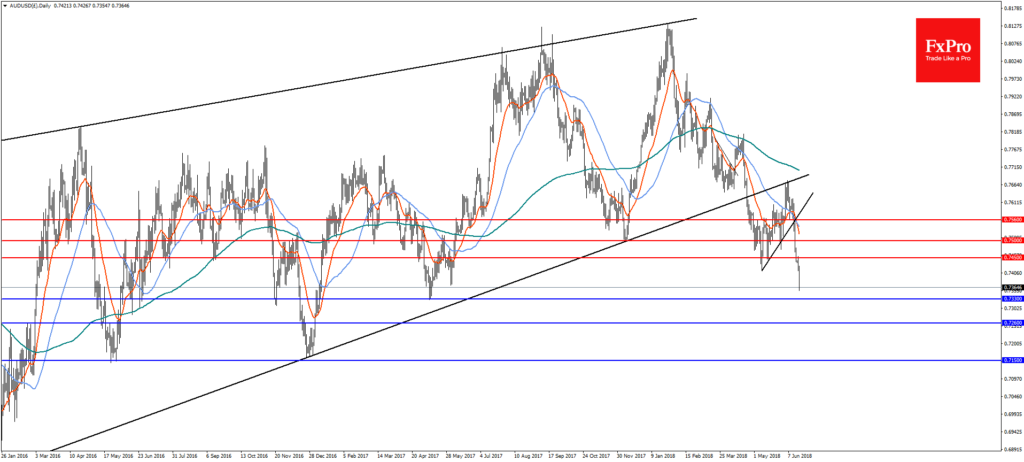

AUDUSD On the daily chart, the AUDUSD pair has broken through the important 0.7500 level after confirming resistance at the December 2015 trend line. Any corrections are likely to be sold as the pair trends lower towards 0.7150 with supports near the 61.8% retracement at 0.7330 followed by 0.7260. Only a reversal above 0.7450 changes the outlook with resistance at 0.7500.

Australian shares were boosted by the weaker currency but closed flat on Tuesday hurt by a sharp fall in iron ore prices. In the daily time frame, the AUS200 index is testing year highs at 6160 and should the trade war concerns subside, a break could open the way for further gains to resistance at 6315 and 6440. On the flip-side, a drop though support at 6000 would lead to further losses with support at 5935 and 5880.