Gold and USDJPY Analysis

July 06, 2018 @ 14:19 +03:00

The major economic data release for today will be the U.S. Non-Farm Payrolls (NFP) and Average Hourly Earnings. The US economy is expected to add another 195K jobs in June with hourly earnings growing to an annualized 2.8% from 2.7% in May. The stronger growth should keep the Federal Open Market Committee (FOMC) on course to implement four rate hikes in 2018 as planned. Provided there is no drastic deviation from expectation, the reaction to NFP should be temporary.

The focus could quickly shift to risk sentiment due to the ongoing trade war. China’s Premier Li has been reacting to the imposition of tariffs this morning with the message that a trade was is never a solution and China will never start a trade war. Li also said that if any party resorts to increase of tariffs, China would take measures in response in order to protect China’s interest. According to a reports China is said to have applied tariffs to the same value of US goods at the same rate effective from 12:01 PM Friday.

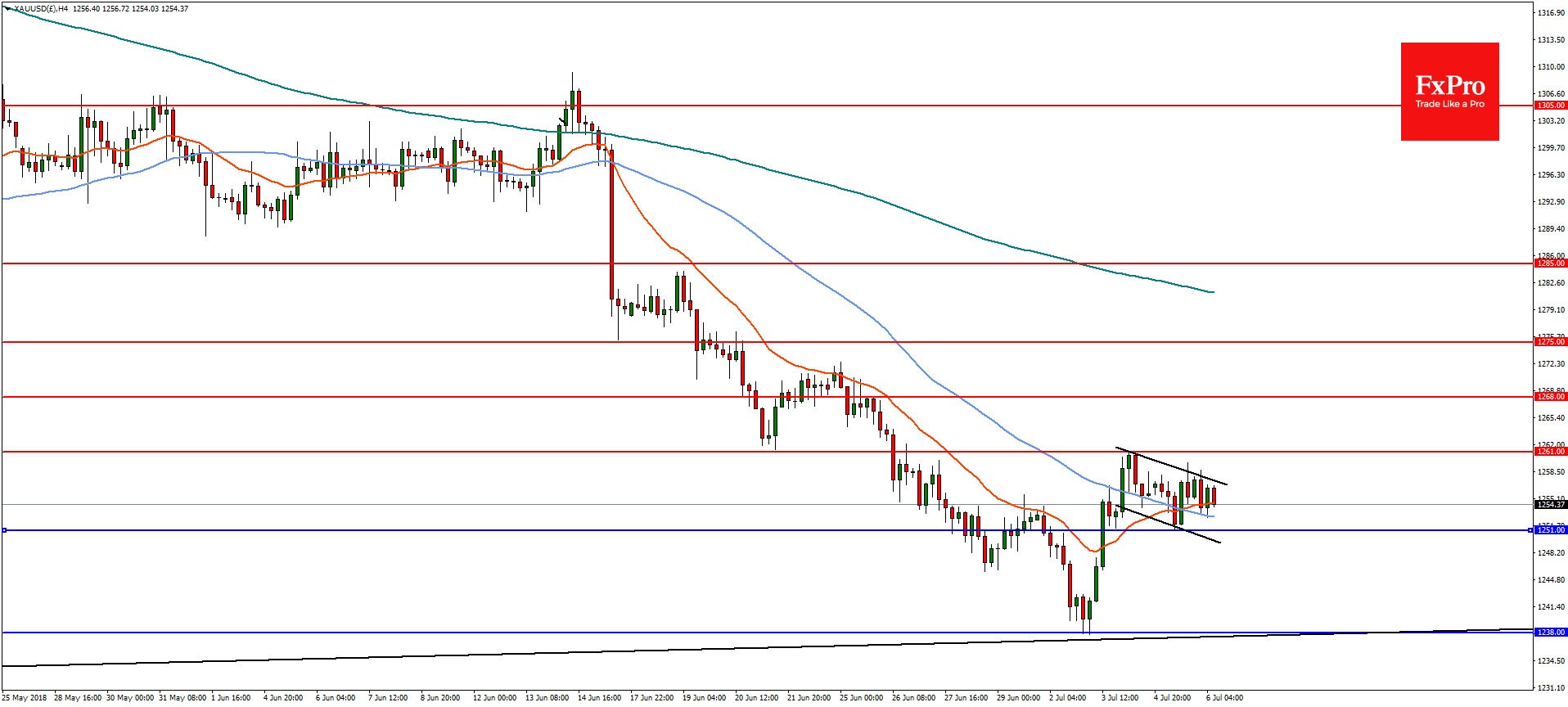

GOLD In the 4-hourly timeframe, Gold recovered from a major horizontal and trend line support at 1238 but has not been able to build on the rebound and is now forming a possible bull flag. The break to the upside would give a measured target at 1275 with resistance at 1261 and the 23.6% retracement of the April highs at 1268. However, a reversal and break of 1251 will likely see another test of the lows at 1238.

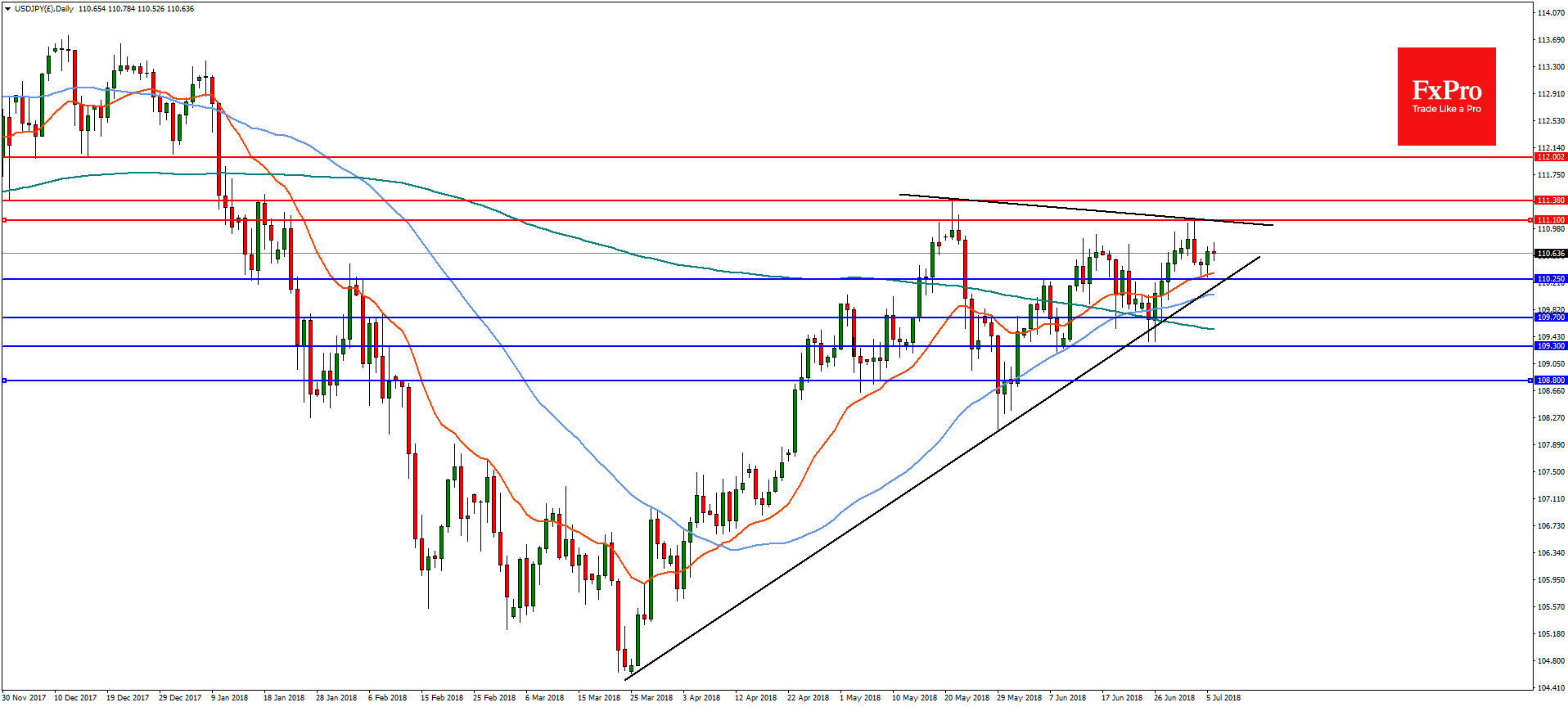

USDJPY An escalation of trade war could cause a reaction in the with a sell off possible. On the daily chart, a break of the March trend line and horizontal support near 110.25 could open the way for declines to near term support at the 23.6% retracement of the March lows at 109.70 followed by 109.30 and 108.80. On the flip-side a break of 111.10 would find resistance at 111.30 and then 112.00.