GBPUSD and GBPAUD Analysis

July 10, 2018 @ 13:23 +03:00

The British Pound (GBP) has recovered much of the losses from yesterday as fears over a challenge to Prime Minister Theresa May’s leadership following the resignation of two ministers have diminished. It is thought that May would win a party confidence vote, however if further compromises were made with Brussels during Brexit negotiations, the issue of her leadership would come into question again. In any case, the British Pound will react to the flow of headlines as the political turmoil continues and the uncertainty will be bearish for the currency. For the moment, the market is still pricing in a rate hike from the Bank of England (BOE) in August which is supportive for the GBP.

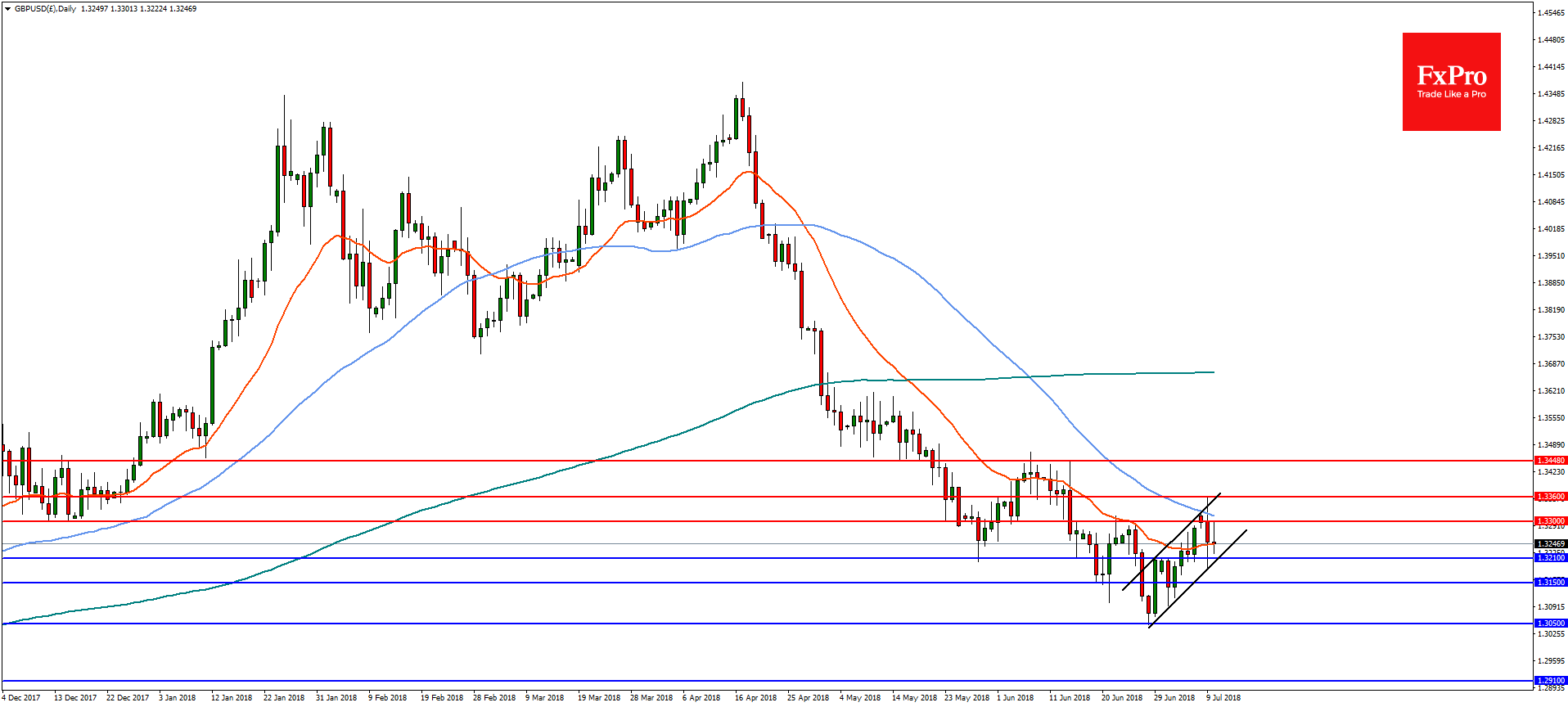

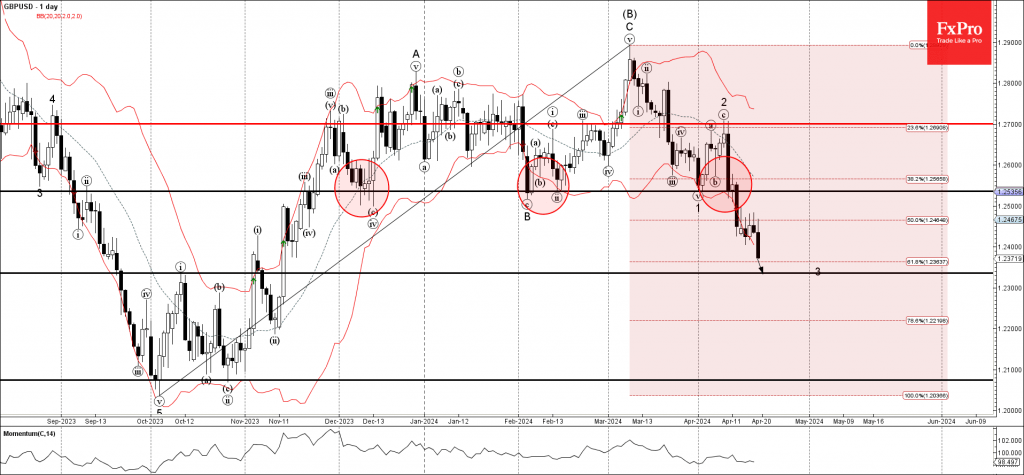

GBPUSD On the daily chart, GBPUSD recovered to the 23.6% retracement from the highs of April to 1.3560 but failed to break the level. The pair is now forming a possible bear flag and a downside break of 1.3210 will likely see the pair drop to supports at 131.50 and then 1.3050. A bullish move above 1.3300 is needed for another test of 1.3360 which will need to be broken for a more meaningful recovery to take place.

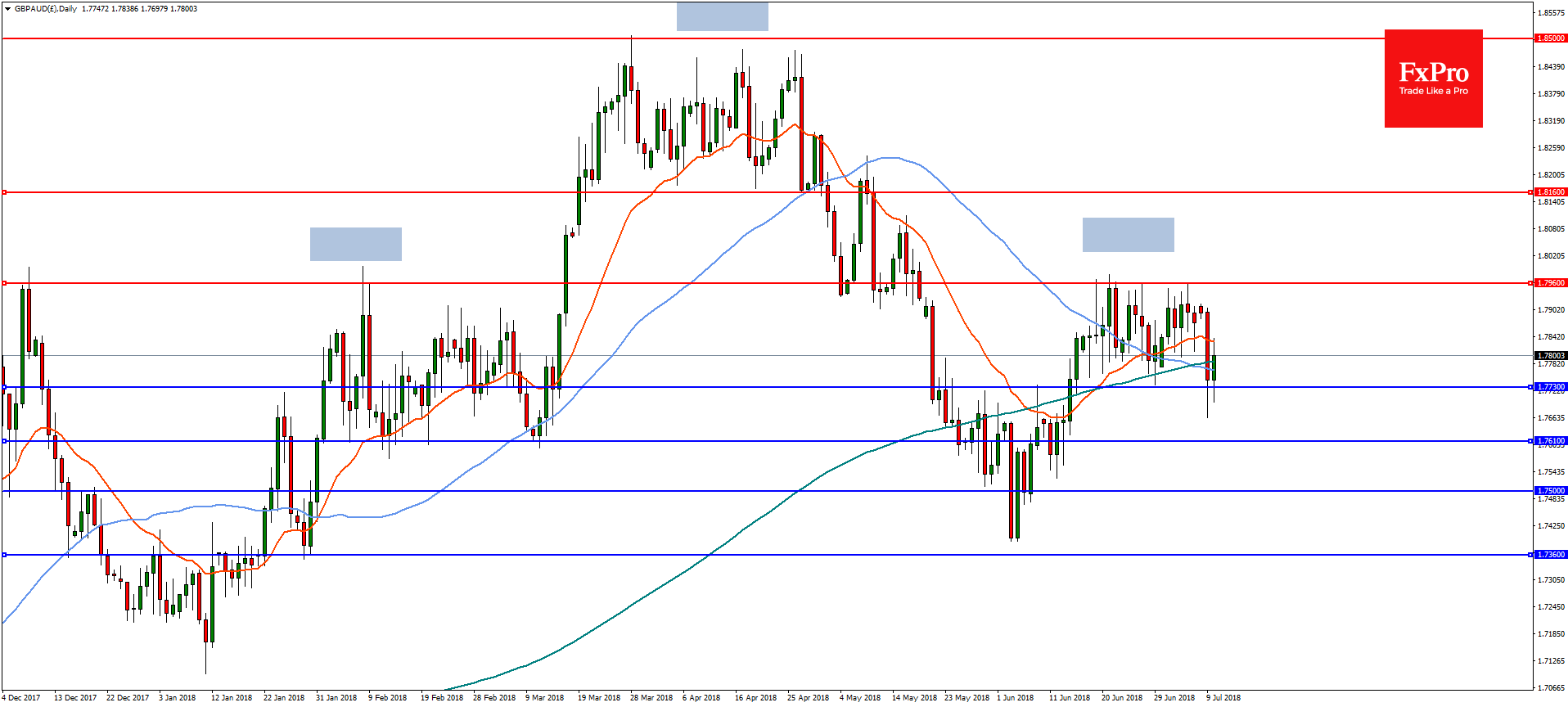

GBPAUD The Australian Dollar (AUD) has been one of the stronger currencies over the last week so with GBP weakness the GBPAUD pair could see significant downside movement. On the daily chart, GBPAUD has failed to break the confluence of horizontal and Fibonacci resistance at 1.7960. The pair is now attempting to break near term support at 1.7730 which would lead to continued downside to the 38.2% retracement of the August 2017 lows at 1.7610 followed by 1.7500. On the flip-side, a reversal above 1.7960 is needed to change the outlook with further resistance at 1.8160.