EURUSD and Gold Analysis

July 12, 2018 @ 16:27 +03:00

The US Dollar has been advancing ahead of the CPI report today which is expected to show the headline rate edge up to 2.9% year-on-year. The US preparing an additional $200bln of tariffs on Chinese imports caused some risk aversion but this has proven to be short lived. However, higher tariffs can be expected to be passed through to consumers and result in higher inflation. This would force the Federal Reserve to hike rates faster. For this reason, today’s CPI release will be very much in focus.

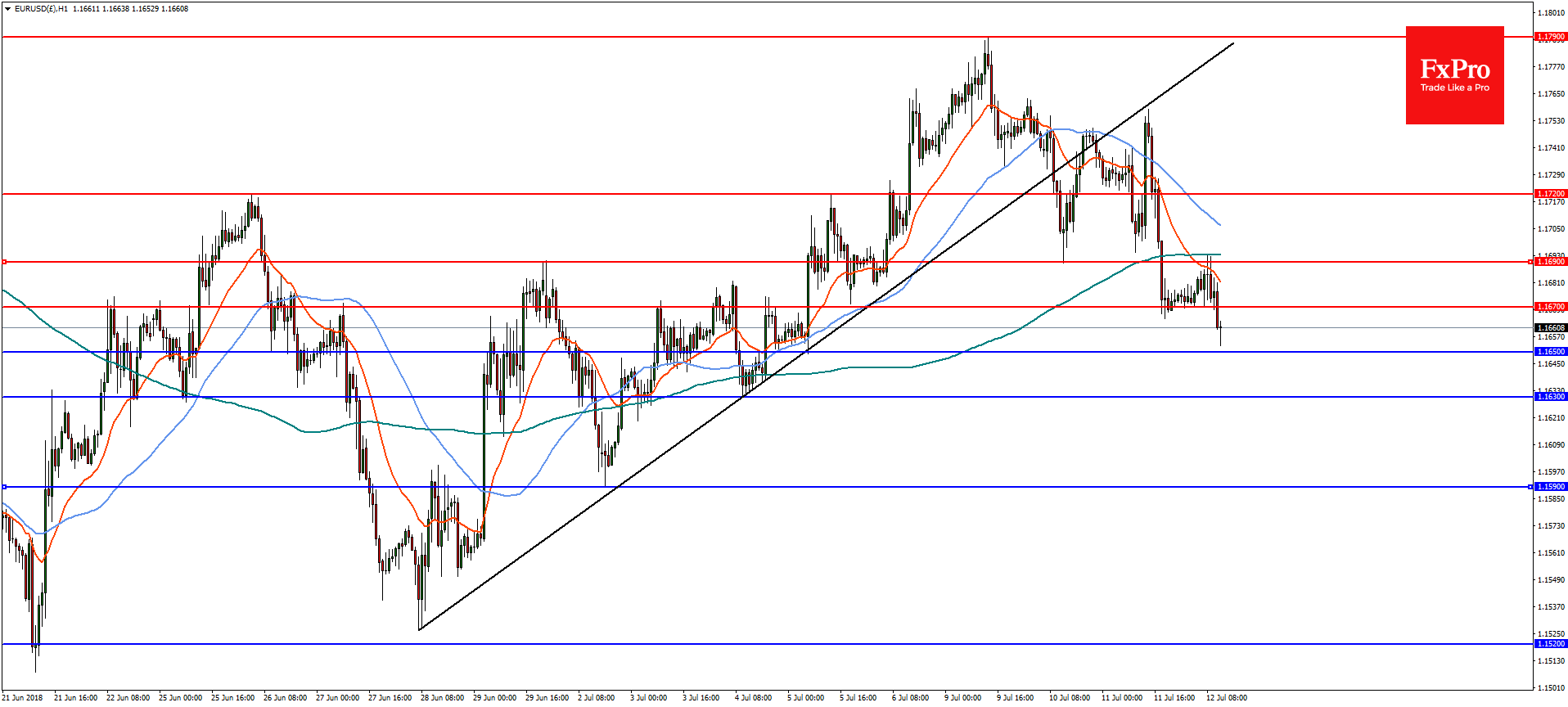

EURUSD German CPI was reported at 0.1% over the month in June while increasing 2.1% over the year so if the US CPI beats, the Euro could come under pressure on the differential. On the 4-hourly chart, the EURUSD pair has broken 1.1670 which could see the pair decline to the near term support at 16.50 and then the 61.8% and horizontal support at 1.1630. An upside break of 1.1670 is needed to open the door for another move to resistance at 16.90 and then 1.1720.

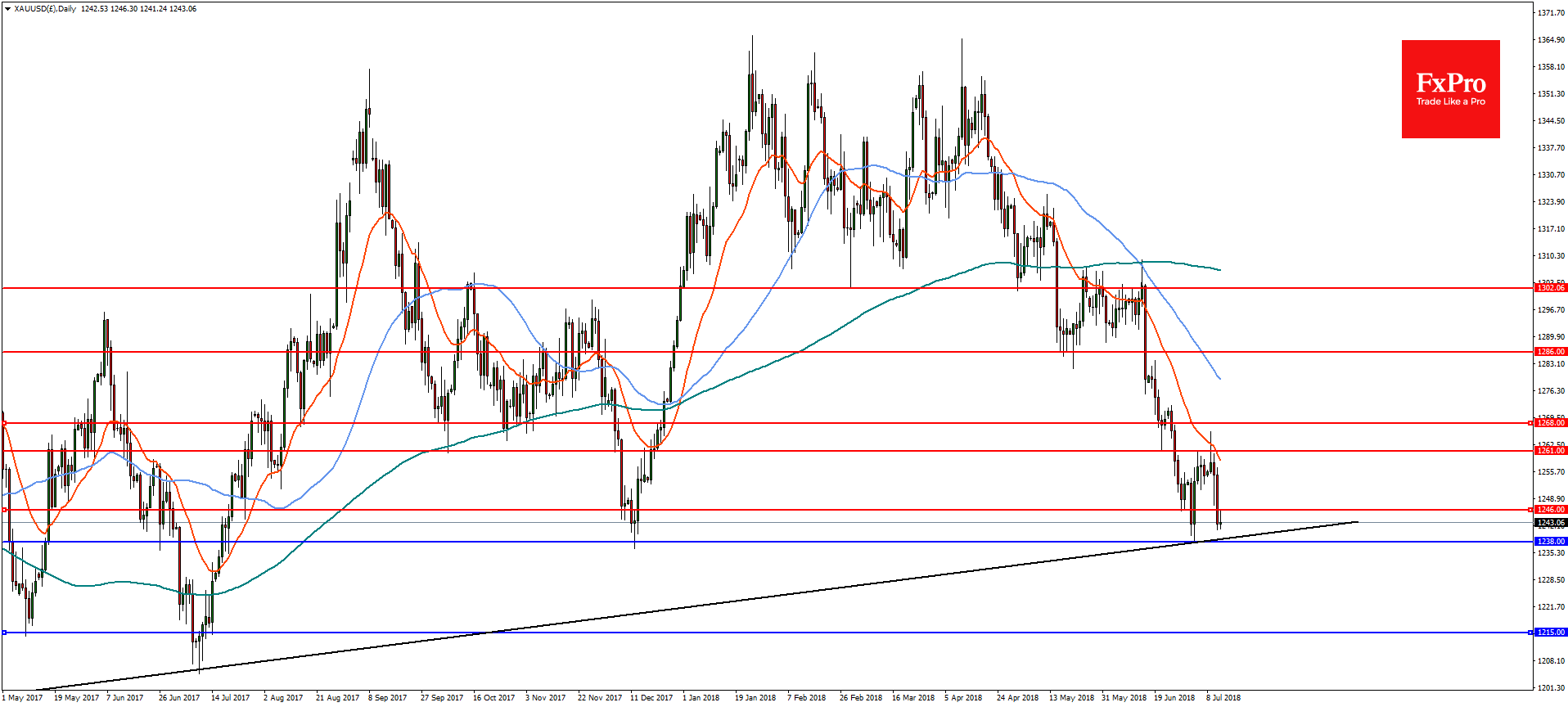

GOLD In the daily timeframe, Gold is again testing a major horizontal and trend line support near 1238. A break of this level could see Gold drop to the 61.8% retracement of the low of December 2016 at 1215. However, if the bulls can defend this level, a reversal above near term resistance at 1246 could lead to a recovery to 1261. A break of the 23.6% Fibonacci at 1268 is needed for continuation towards 1286.