Another set of statistics from China has added to the wave of disappointment over the momentum of the world’s second-largest economy, prompting a dichotomic response from regulators.

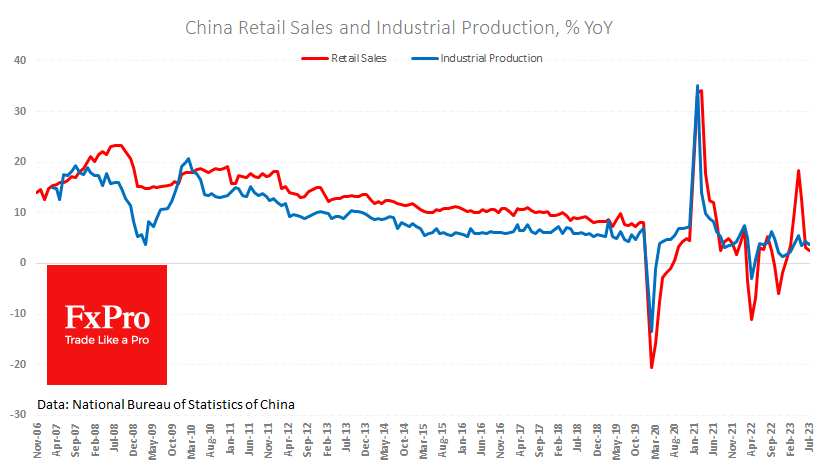

Retail sales in July were only 2.5% y/y, down from 3.1% y/y in the previous month and in stark contrast to the expected acceleration to 4.2% y/y. Until now, there has been a lack of visible results from the measures taken to stimulate final demand. China continues to struggle to rely on domestic demand as a source of growth.

Industrial production failed to impress either, rising 3.7% y/y after 4.4% in the previous month and worse than expected at 4.3%.

The unemployment rate unexpectedly rose to 5.3%, and urban youth unemployment figures were “suspended” after the numbers exceeded 21.3% in June.

Shortly after the statistics release, the People’s Bank of China cut its medium-term lending rate by 0.15 percentage points to 2.5%. The weak economic data and the rate cut put pressure on the Yuan. The USD/CNH exchange rate was above 7.32 on Tuesday and was only higher for a few days in October-November last year. Consistently higher, it was traded until 2008. This is an explainable market reaction to the dramatic shift in expectations and the divergence in US and Chinese monetary policy.

What is more difficult to explain are reports that state banks have become active in the foreign exchange market to protect the national currency from depreciation. The dichotomy of such moves is that the weakening of the exchange rate can boost exports and stimulate domestic purchases. In contrast, attempts to stop the exchange rate deterioration against macro data only lead to the burning of reserves.

The FxPro Analyst Team