Without confirmation from BTC, altcoin’s growth could be a trap

September 09, 2021 @ 13:56 +03:00

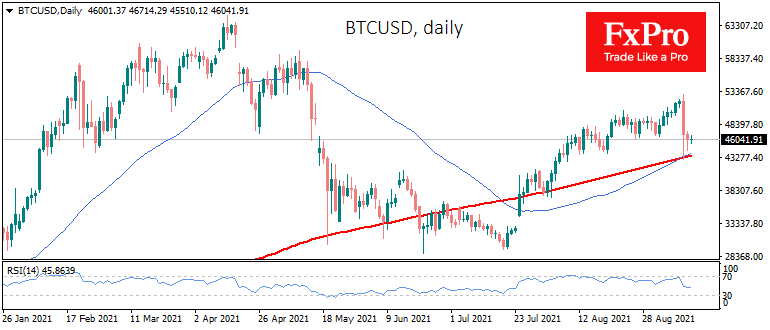

Bitcoin remains under moderate pressure on Thursday, trading near $46.3K, down 12.5% from Tuesday’s peak. Meanwhile, the total capitalisation of the crypto market has surpassed $2.1 trillion this morning.

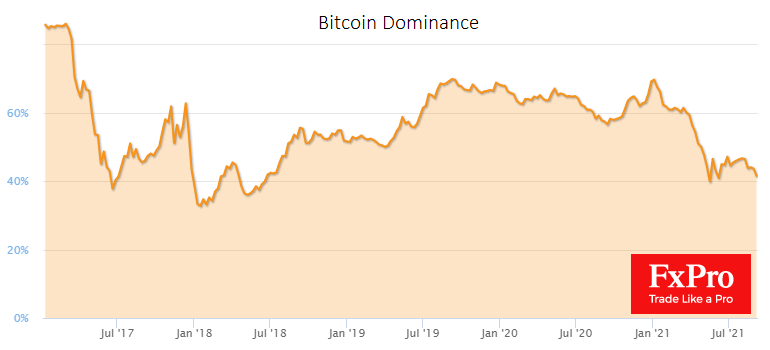

Overall, the trend of bitcoin’s share of the crypto market remains down, except for a brief period when altcoins collapsed following the first cryptocurrency. Bitcoin’s share of total capitalisation fell to 40.8%, the lowest since May when an altcoin sell-off temporarily reversed the trend.

A repeat of the same scenario is to be feared this time as well. The fall in bitcoin’s share caused by its falling price rather than outpacing the rise in altcoins has repeatedly turned into a massive surrender by buyers.

We saw the most striking example of this pattern in late 2017, when BTC turned down in mid-December, its share dropping to less than a third in the following month. The trend then reversed, and altcoins found themselves under a prolonged sell-off. Many of the then-existing altcoins are still an impressive distance from the record levels of January 2018.

The most favourable environment for the crypto market is bitcoin rising at a slower pace than altcoins. A fall in the price of the market flagship risks a sharp sell-off in altcoins as early as September.

And in this case, the technical picture in BTCUSD is worth paying particular attention to. The price touched 43K during Tuesday’s sell-off, where the 50-day and 200-day simple moving averages intersect, and the fight for these levels is far from over. If Bitcoin manages to stay above those levels by the end of the week, the chances of buyers coming in on the downside will increase considerably, which would pull the price up. In that case, the altcoin position could recover even faster, and there will be a more significant reason behind the current rise.

If BTCUSD falls below its key moving averages, it could trigger a new crypto-winter, repeating the situation from May 2018. Back then, BTC lost more than 60% in the next seven months after falling under the same averages and managed to return to those levels a year later. In our case, this could escalate into BTCUSD falling into the $22-28K area, rewriting last summer’s lows.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks