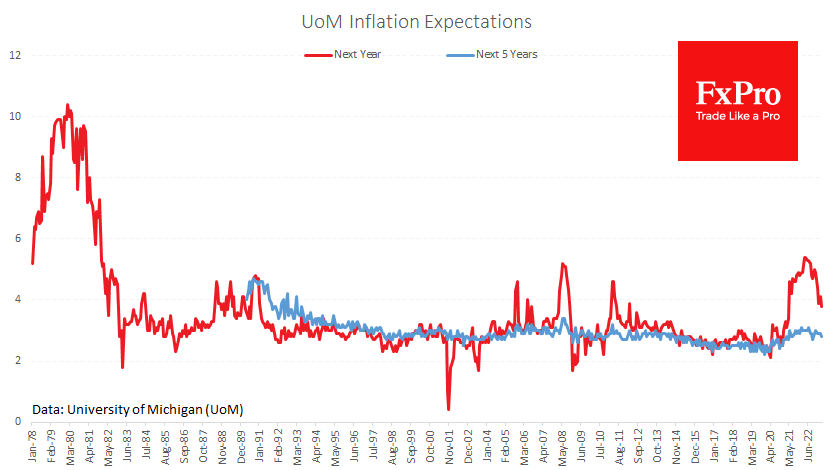

US inflation expectations are declining, which could be good news for the stock market, suggesting less pressure on the Fed to raise interest rates. The University of Michigan’s inflation expectations index for the year ahead fell to 3.8%, the lowest since April 2021. This is still above the 10-year average of 3.1%, but it is a move in the right direction despite a tight labour market and above-trend wage growth. Lower fuel prices and the resolution of logistical problems are helping to stabilise short-term inflation expectations.

Five-year expectations are also creeping down, falling to 2.8% (the lowest since July 2021) and approaching the 10-year average of 2.7%.

Technically, the current indicator gives the Fed some room to manoeuvre on interest rates. However, investors and traders have largely ignored the macroeconomic data recently and focused on the banking situation. Just over a week ago, the main scenario was a 50-point hike, and now the odds of an unchanged rate are estimated at 33% (67% for a 25-point walk).

On Thursday, the ECB clarified that it is committed to fighting inflation and is ready to act if banks get into trouble. The big question now is whether the Fed will split the fight against inflation and support for the banks into different tracks. If so, we should not be surprised to see a rate hike and a commitment to further rate hikes, which could be bullish for the dollar and bearish for the equity and gold markets.

The FxPro Analyst Team