Every price rally of 2019 has ended in tears. The latest will probably end similarly. It is based on hope that ending the U.S. – China trade war might improve the economy and oil demand. It is also based on belief that yet another OPEC+ production cut will make a difference. In other words, it is based on sentiment.

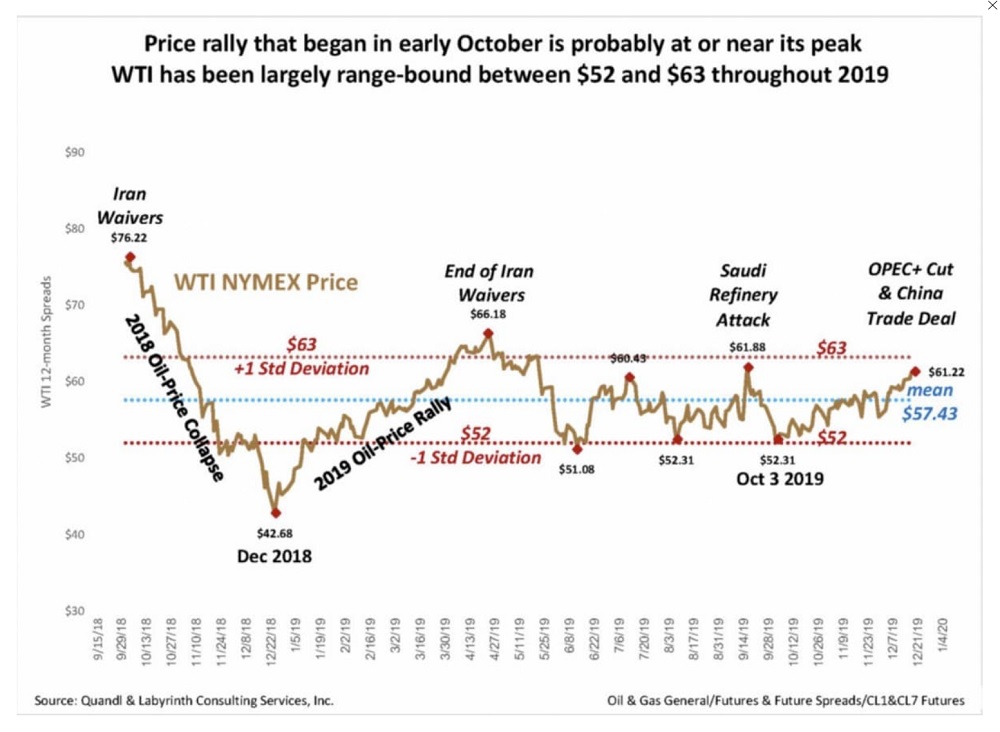

WTI prices began increasing in early October from a low of $52.31 and reached $61.22 on December 19. $52 was one standard deviation less than the WTI mean for the last 15 months. Each price rally of 2019 began within a dollar of this low and ended in the low-to-mid $60 range, about one standard deviation more than the mean.

The oil price-rally that began in early October is probably at or near its peak. The WTI oil-price volatility index OVX has fallen sharply (-32%) since November 29. Tight oil rig count has decilned since November 2018 and is expected to continue to decline. Total U.S. production will probably be flat for the first half of 2020. Increasing WTI price with increasing comparative inventory (C.I.) is anomalous.