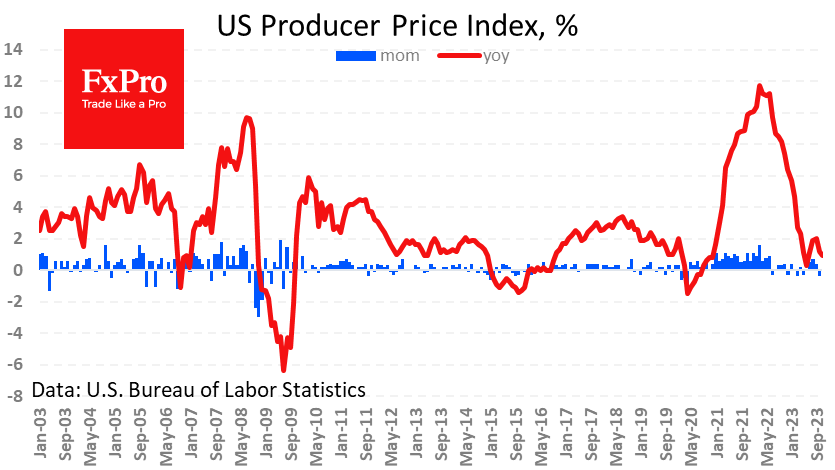

US producer prices came out weaker than expected, increasing speculation that the Fed may soon turn to policy easing, causing pressure on the dollar.

The overall and core producer price indices showed zero change for November and slowed from 1.2% to 0.9% and 2.3% to 2.0% year-over-year, respectively. This is below expectations and comes as a surprise after the slightly stronger consumer inflation data (which are usually closely correlated).

Producer inflation went to a level that does not worry the Fed and supports a wait-and-see approach. The here and now is a reason for the market to build up risk appetite, suppressing the risks of further rate hikes. But it would be reckless to lose sight of the bigger picture, in which falling commodity and manufacturing prices are a sign of demand problems. And that’s bad news for buyers of equities at current levels.

The FxPro Analyst Team