Weak German manufacturing pressured EUR

April 09, 2021 @ 13:16 +03:00

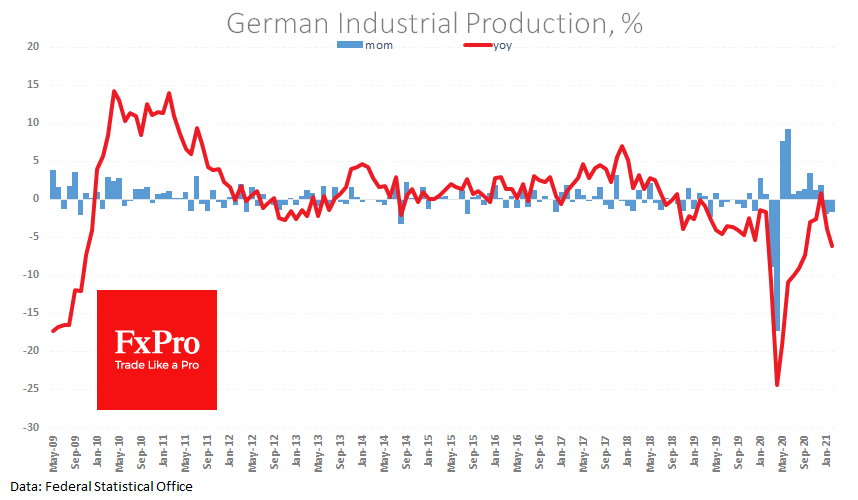

Economic data in Europe is very volatile and contradictory. Data was released at intervals of just a few hours, showing a dip in Germany’s industrial production and a reduction in foreign trade surplus, with robust retail sales in Italy.

Against a background of increased infections and national lockdown, German production fell by 1.6% in February, in wild contrast to average expectations for 1.6% growth.

The decline to the same month one year earlier intensified to 6.4%. Particularly worrying is that this contraction started long before the pandemic. The seasonally adjusted index is now 10.3% below the peak levels of May 2018.

That is when the first shots of the China-US trade war rang out. Germany is a net exporter to the planet’s biggest exporter, China.

Weakness in German industrial production looks like timely news for a weekly take-profit from this week’s euro rise. For the short-term, if EURUSD closes the week below the 200-day average (1.1886), it could add to the pair’s pressure next week.

The FxPro Analyst Team