Financial markets have staged an impressive rally across a broad range of instruments. This is an essential signal that risk appetite improves after about a month of correction. But based on the idea that “the worse, the better”, such a rally could be a trap.

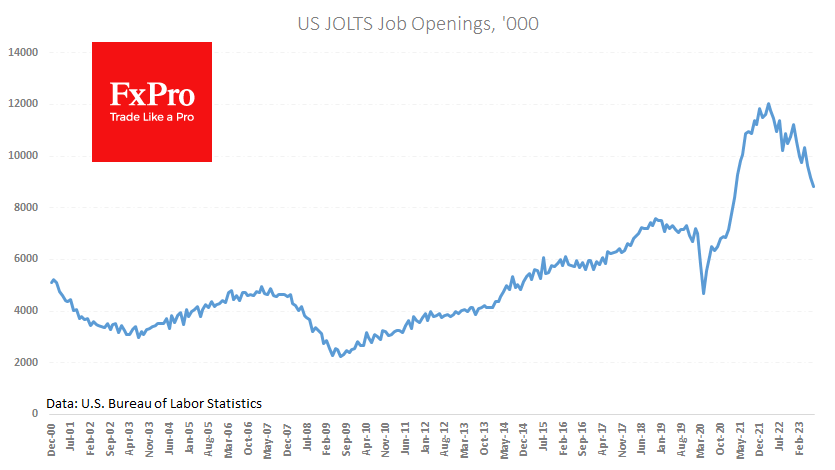

Sentiment in the US equity market improved markedly on Tuesday after a cocktail of economic data was released at the start of US trading. The Consumer Confidence Index fell from 114 to 106.1 in August, instead of the expected rise to 116. The number of job openings fell to 8.827 million in July, the lowest since April 2021, as demand for remote work cooled and the overall labour market saturated. At the same time, an increase to 9.5 million was expected.

The reports showed the economy slowing under the weight of interest rates at a time when markets are used to stronger-than-expected data. In the wake of the releases, expectations of a quick reversal in Fed policy and that we will see no further tightening were slightly reinforced.

This is a bold expectation and contrasts with the overtly hawkish rhetoric of most FOMC members in recent days. A year ago in Jackson Hole, Powell called for pain to be endured to fight inflation. But that moment seems to have arrived only now. The thick layer of stimulus money easily explains the delay that households and businesses have accumulated throughout the pandemic. Government spending has remained high, with the US running a record budget deficit.

This does not look like a solid foundation for economic growth, and the joy of anticipating a soft Fed policy tends to be replaced by a quick realisation of the gravity of falling incomes.

Most surprisingly, the one-and-a-half per cent rally in the S&P500 was triggered by a change in the probability of a November rate hike from 62.2% to 50.7%. This compares with 42.2% a week ago.

In the short term, traders will likely focus on the S&P500’s momentum near the 50-day moving average at 4465, which the index crossed yesterday, on its way to the 4500 level. The ability to extend the advance will signal bullish dominance in the markets. A move below 4450 would suggest we saw a false breakout on Tuesday.

The FxPro Analyst Team