Warning Signs of the Debt Markets

July 03, 2019 @ 12:25 +03:00

Anxiety about the global economy growth rate and the threat of new EU tariffs set to be launched by the US is keeping investors from actively buying profitable assets. On the debt markets, there is a declining trend in the yield of long-term government bonds of developed countries: American 10-year-old treasuries dropped to 1.95%, and the German Bonds update their historical minimums at -0.40%. This should be regarded as a sign of concern about the long-term growth rate, despite the expectations of incentives in the short term.

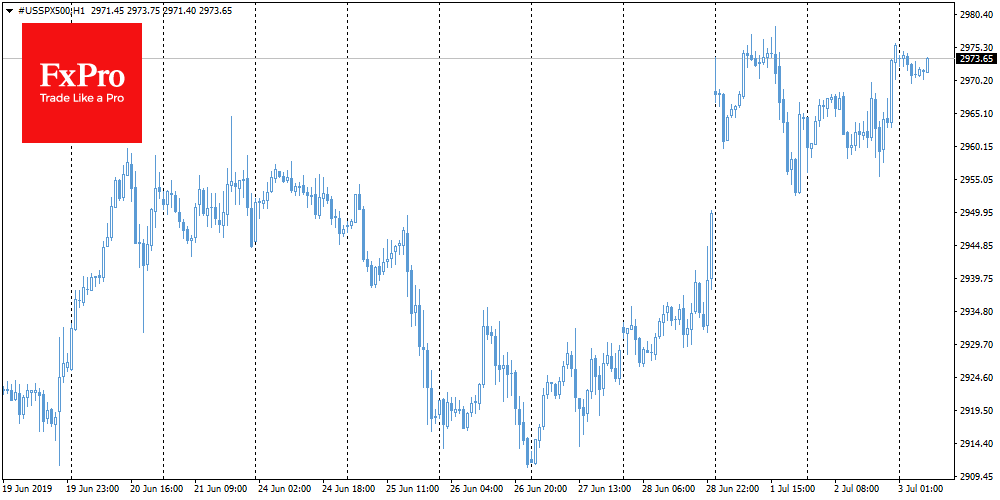

Stocks The S&P500 spent Tuesday near the opening levels and only returned to highs at the end of the day. We have repeatedly noted that this is a good signal for stocks since it reflects confidence in the prospects from professional investors. According to FxPro analysts, the decline in yield is an alarm, setting up a possible correctional pullback of stock exchanges in the coming days.

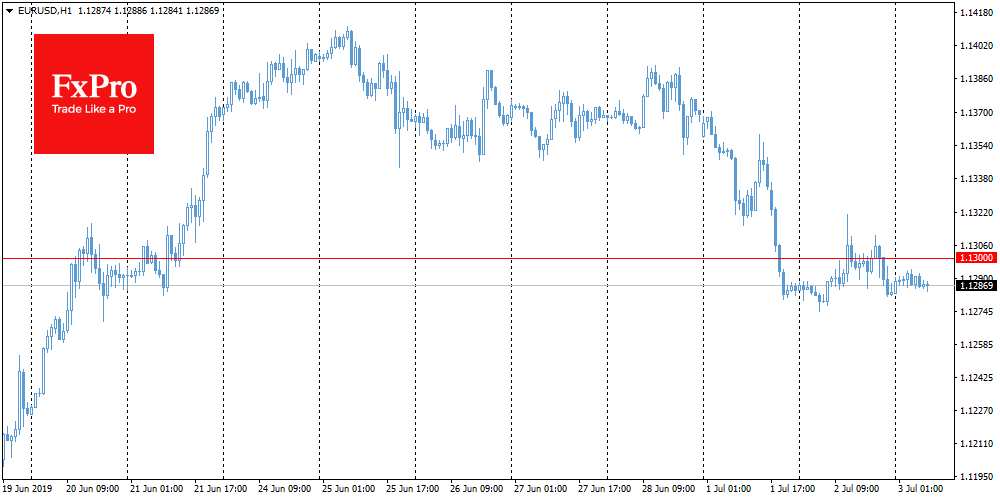

EURUSD On Tuesday, the single currency unsuccessfully attempted to return above 1.1300. However, by the end of the day, dollar purchases increased, returning EURUSD to the two-week levels. Today, several PMIs in services are published that will once again compare the US and EU economy dynamics. On Monday, the EU production data came out weaker than expected, while the US indicators are exceeding forecasts and are expected to stay noticeably stronger than the EU’s. As a result, this has placed significant pressure on the EURUSD at the beginning of the week, continuing into today. Similar data divergence can reinforce the downtrend on EURUSD.

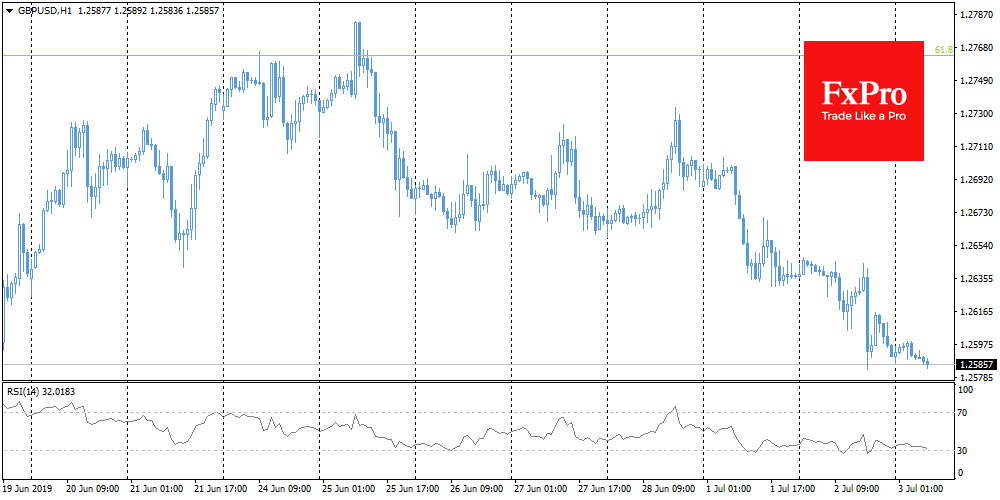

GBPUSD The British pound risks becoming another victim of a dovish turn in the central bank’s rhetoric. During yesterday’s speech, Bank of England Governor Mark Carney noted the growing risks for the national economy, due to the global trade wars and the effect of a potential ‘no deal’ Brexit. As a result, GBPUSD fell 0.4% to 1.2580. More and more central banks of developed countries are getting involved in the soft version of currency wars, either reducing rates or promising to do so in the near future.

The FxPro Analyst Team