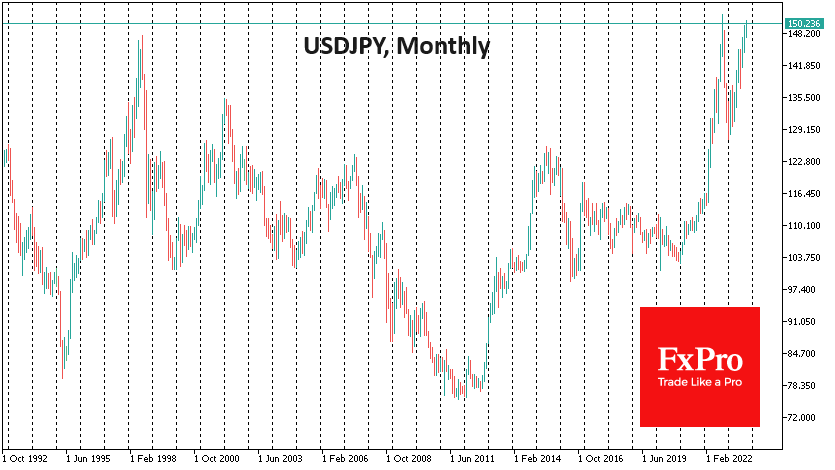

A strengthening US dollar pushed the USDJPY to 150.77 early Thursday. Except for just over 20 hours on 21 October 2022, the pair hasn’t traded higher since 1990.

Almost a year ago, a breach of the round 150 level triggered a decisive intervention by the Japanese Ministry of Finance, breaking the pair’s bullish trend and pushing it back below 128 less than three months later.

Considering this history, the market failed to break through this round level, approached in early October. There were many sharp spikes in Yen gains during the month, raising whether these were interventions initiated by the Japanese Ministry of Finance. In contrast to developments last year, the short-term spikes were not followed by a continuation, raising doubts about the authorities’ resolve.

There is a risk that it is not in Japan’s interest to repeat last year’s actions. The authorities are not targeting a specific level but are assessing volatility and the impact of the exchange rate on inflation. Sharp movements in the exchange rate undermine economic activity, forcing exporters and importers to postpone transactions to a point of equilibrium if possible. This is why we often hear from officials that large exchange rate movements are undesirable. However, intervention only increases this volatility.

The impact on inflation is not the nominal yen exchange rate but the change compared with a previous period, such as a year ago. A year ago, the nominal yen exchange rate against a trade-weighted basket depreciated by 15% y/y; now, it is down by only 3% y/y, which means that its contribution to inflation is close to zero, although it is not an inflation-fighting regime.

So, it is possible that the enormous focus on the yen at 150 by traders and FX market commentators has not resonated in the hearts of Japan’s policymakers, who see no immediate need to intervene in the situation, especially as it is not free.

Unlike intervention to weaken the local currency, attempts to support the exchange rate are backed by the sale of foreign exchange reserves, depleting the country’s reserves. To make matters worse, the value of US government bonds (the most liquid instrument for intervention) has fallen sharply in recent months.

So, at current levels, it is safer to expect Japan’s MoF to turn the tide with intervention but will only limit USDJPY gains, even though the real effective yen exchange rate is at its lowest since 1970.

The FxPro Analyst Team