US unemployment could reach 20% if Congress doesn’t enact the trillion-dollar stimulus package

March 18, 2020 @ 11:19 +03:00

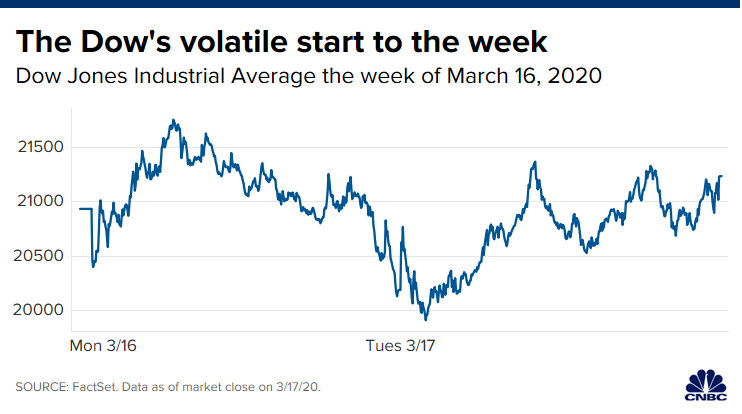

Stock futures fell in early morning trading on Wednesday as the markets remained highly volatile with the government response to the coronavirus fallout still unfolding. As of around 1 a.m. ET, futures on the Dow Jones Industrial Average fell 821 points, indicating a more than 1,000-point loss at Wednesday’s open. S&P 500 and Nasdaq-100 futures were also down.

Futures contracts for the indices were in “limit down” territory, a situation where trading is halted after they have hit a 5% loss and can go no lower. Recent overnight trading of futures contracts have seen extreme volatility, leaving many investors to believe computer trading has exaggerated moves in the market’s collapse stemming from the coronavirus outbreak.

The movement comes amid historic highs on the Cboe Volatility Index, which closed above its 2008 financial crisis peak on Monday. That index looks at options prices for the S&P 500 and is also known as the “fear gauge” of Wall Street. On Tuesday, the markets rebounded from their deepest rout since 1987 as investors grew hopeful that the Trump administration’s massive fiscal stimulus plans will rescue the economy, which is at risk of falling into a recession due to the coronavirus impact.

The White House is weighing a fiscal package of more than $1 trillion that includes direct payments to Americans and financial relief to small businesses and the airline industry. Treasury Secretary Steven Mnuchin also said corporations will be able to defer tax payments of up to $10 million while individuals could defer up to $1 million in payments to the Internal Revenue Service. Mnuchin told Republican senators that unemployment could reach 20% if Congress doesn’t enact the trillion-dollar stimulus package he proposed, CNBC reported Tuesday evening, citing a source familiar with the matter.

US stock futures fall into ‘limit down’ range, pointing to another day of losses, CNBC, Mar 18