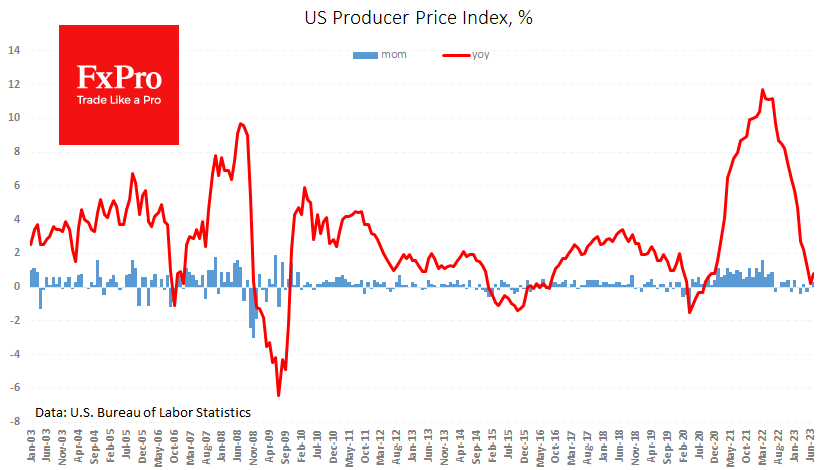

US producer prices, both including and excluding food and energy, rose 0.3% m/m in July. This is the first positive surprise for the indicator in six months – before this, prices had regularly missed average forecasts, supporting expectations of a rapid easing of price pressures.

The annualised growth rate for the headline index rose from 0.2% to 0.8%. The core price index maintained its growth rate of 2.4% y/y. The main driver of price growth in July was higher service prices, among which distributive trades (+0.7% m/m) stood out. Among the goods groups, food was the main price driver.

This report may reinforce expectations of a second wave of inflation, this time linked to the strength of the economy, which is pushing up prices of services and several commodities.

Such data may not be enough to seriously reinforce expectations of a Fed rate hike in September, with the odds now estimated at 13.5%. However, interest rate futures are pricing in a 33% chance of a hike before the end of the year, up from 25% a week ago.

In other words, markets continue to move away from their initial assumption that a rapid cut would follow a sharp hike. And this idea is not sitting well with the equity indices, as the most interest rate sensitive Nasdaq100 fell 0.8% on the latest report, taking its losses for the day to 1.2%. This dip below the 50-day moving average suggests a growing chance of a correction to the year-to-date gains.

The FxPro Analyst Team