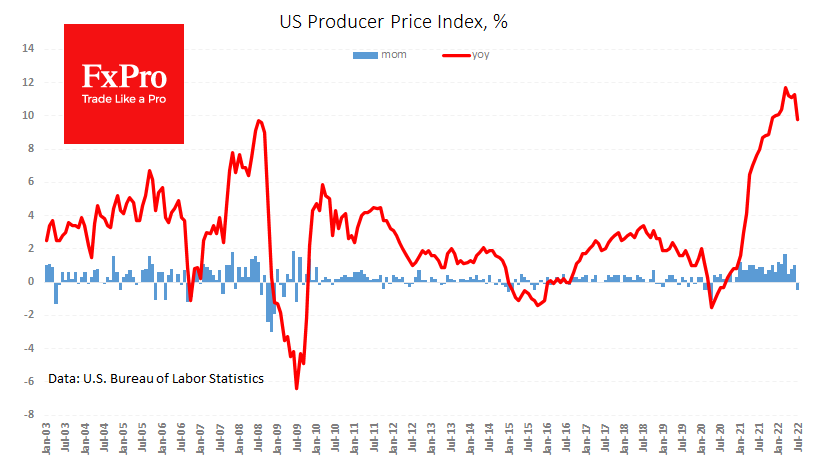

US producer prices fell by 0.5% in July, the first decline after 26 months of growth. The year-over-year PPI rate returned to the single-digit territory at 9.8% against a peak of 11.7% in March and 11.3% a month ago.

Producer price trends are a couple of steps ahead of consumer inflation, so the first fall of the index in more than two years further strengthens the market sentiment that the Fed will tighten policy further in smaller steps.

This is both good news for financial markets and bad for the USD. For the stock market, falling prices mean lower costs, which have recently held back the economy. Furthermore, weak inflation benefits growth companies as it will allow the Fed to raise rates less and turn more quickly to easing.

The latter thesis is still somewhat controversial, as FOMC officials deny any intention of stopping soon and reversing quickly from a rate hike to a rate cut. Markets have their own opinion, with little confidence in the Fed after its mistake with “transitory” inflation.

As a result, we see a further decline in expectation of the Fed’s next moves and a renewed momentum of pressure on the dollar. Next in the spotlight for traders and investors are import prices and the first estimates of consumer sentiment released on Friday, which could contain or reinforce buyers’ optimism.

The FxPro Analyst Team