US NFP delights markets, but jobless claims are worrying

July 02, 2020 @ 18:39 +03:00

Monthly US employment data impressively exceeded expectations, noting job growth of 4.8 million (3.0-3.2 million expected). Besides, the unemployment rate (fell from 13.3% to 11.1%) and the share of the economically active population (increased from 60.8% to 61.5%) were better than expected. Much better than analysts’ average expectations, these data managed to develop a positive tone for the markets before the long weekend. S&P500 at one moment rose to the highest levels in the last three weeks, retesting the resistance at 3155, about which the index stumbled all this time. In the foreign exchange market, EURUSD jumped to 1.1300 in the wake of a recovery in demand for risky assets.

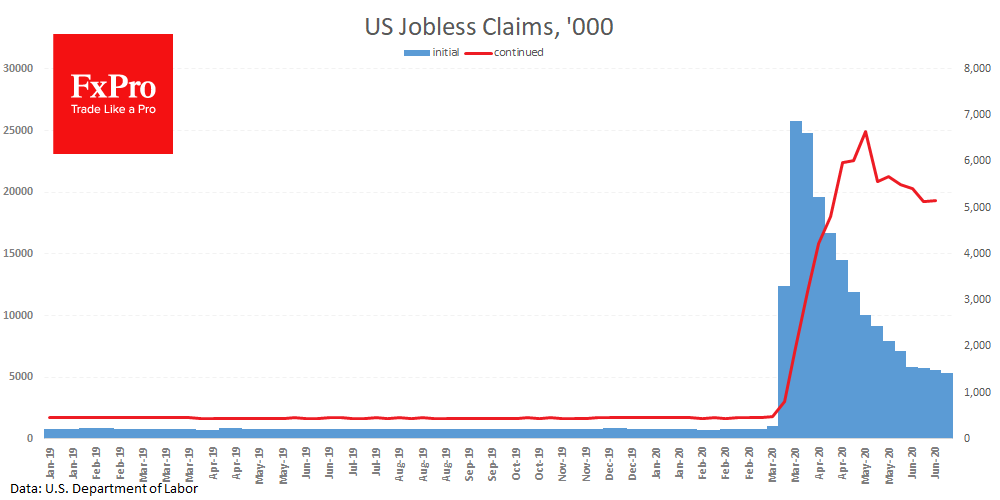

However, do not entirely discard more up-to-date jobless claims data. They once again noted how the economy stalled after the initial rebound. Last week, 1.427 million people applied for initial unemployment benefits insurance. Continued claims counted to 19.29M, compared with 19.231M a week earlier. In both cases, the impulse to improve indicators has noticeably disappeared.

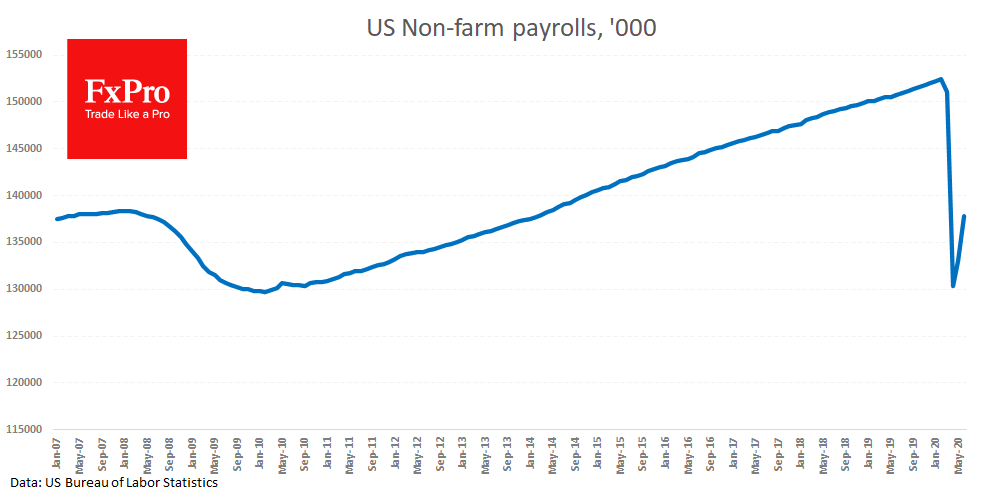

If to rely on data on weekly claims, it is easy to assume that the recovery of jobs in the US has finally stalled in the second half of the month. Moreover, the evaluation of data for NFP occurs in the first half (until June 12). Also, as we noted earlier, it is worth considering that in June the number of jobs was 14.7 million lower than the February peak (-9.6% of the total number of employees), the aggregate hours worked index was less by 10%. The aggregate payrolls index still 7.2% below its peak.

Thus, one should be very careful about market optimism regarding labor market data, since it still looks precarious and far from the norm.

The FxPro Analyst Team