US jobs data are weak, but only at a first glance

October 08, 2021 @ 17:02 +03:00

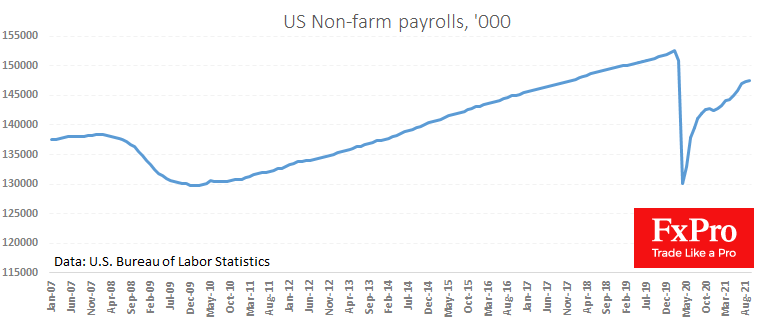

The US economy created 194K jobs in September, well below the 490K-500K expected. Furthermore, employment estimates from ADP and weekly jobless claims set up even stronger data, highlighting the contrast between expectation and fact.

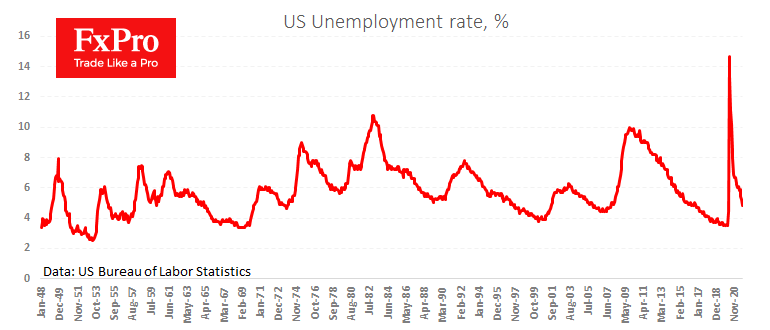

However, not all numbers are weak. The monthly data has been revised up, and the unemployment rate has fallen from 5.2% to 4.8%. The fall in the unemployment rate remains the fastest in the more than 70-year history of this indicator, although job growth missed optimistic short-term hopes.

The rate of wage growth also remains elevated. Average hourly earnings rose 0.6% month-on-month and 4.6% year-on-year, developing an acceleration. The data suggests that Americans are in no hurry to work even though the unemployment benefit programmes have expired and companies are posting a record number of job openings.

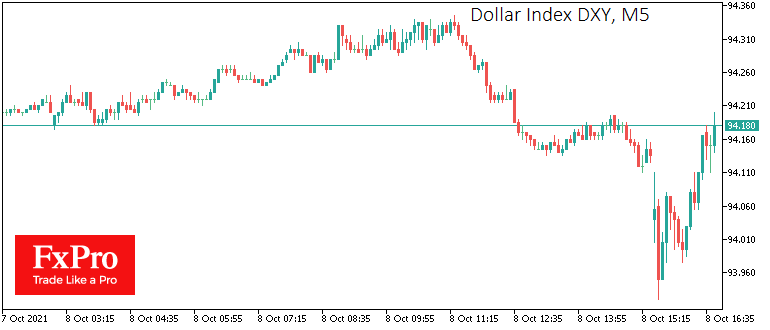

The initial reaction to the monthly jobs report has been pressure on the dollar and strength in equities and precious metals markets. However, the robustness of this reaction should be tested in the coming hours as a more detailed analysis raises doubts that this slowdown will be enough to stop the Fed from starting to roll back QE from November.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks