US inflation will determine the tone of the Fed and the path of markets next week

December 10, 2021 @ 15:21 +03:00

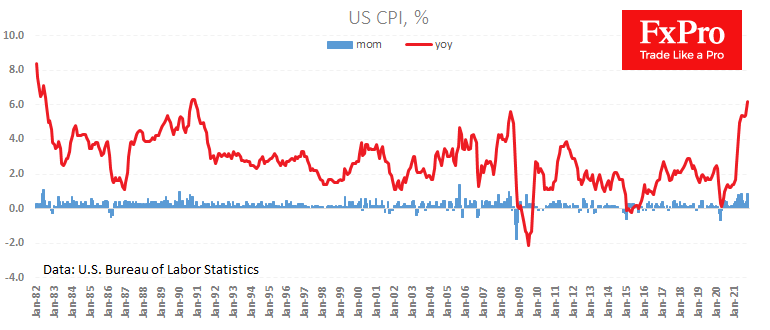

Financial markets are waiting with increased attention to US inflation data. Analysts, on average, expect year-over-year price growth acceleration from 6.2% to 6.8%. Traders in the markets will be looking for answers to whether the peak of inflationary pressures has passed or whether price increases are spreading more widely across the economy.

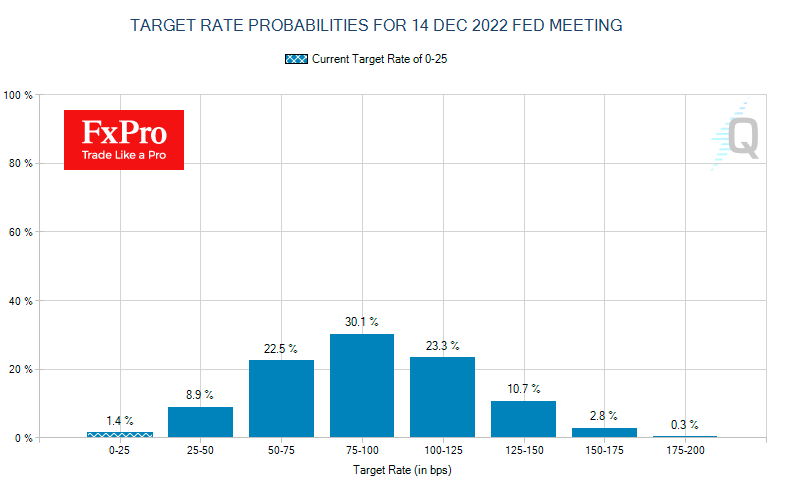

Next week, the Fed’s tone of comments and action will largely depend on this. Signs that the inflation spiralling across the economy will force the central bank to power its efforts to combat it. Markets are now laying high odds that the Fed will double the pace of unwinding in December, assuming QE is completed in March/April, clearing the way for an earlier rate hike, possibly as early as May. Fed rate futures lay down a 63% probability of a rate hike by May. CME’s FedWatch Tool shows more than a 98% probability of one increase by the end of 2022, for two hikes an 89.5% chance and 67% for three.

These expectations are, in our view, overly optimistic. Since the 2008 crisis, we have also seen a rapid recovery in inflation, but growth has been highly unstable. Despite the historically low unemployment rate, the US economy now employs around 4 million fewer people than before the pandemic.

Although rising prices are often cited as a problem for business, it is still notable that wage growth (+4.8% y/y) is lagging CPI, reducing the welfare of the US population. Will accelerating QE and rate hikes, a market correction, and a cooling of the economic growth rate help solve this problem? The answer is more likely no than yes. Negative stock market performance often sharply reduces the propensity to buy.

We also assume that an 8% increase in the dollar index in less than six months and the easing of logistical problems will bring the states closer to the peak of inflation. Of course, the big question is whether it will return to the 2% target in the next 12-18 months or hover around 4%. In the second case, the Fed would normalise policy as it was able to do before the global financial crisis and move away from a zero-interest-rate policy.

However, it seems prudent for the Fed to leave the door open for a more rapid monetary policy tightening but not to rush into action right now.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks