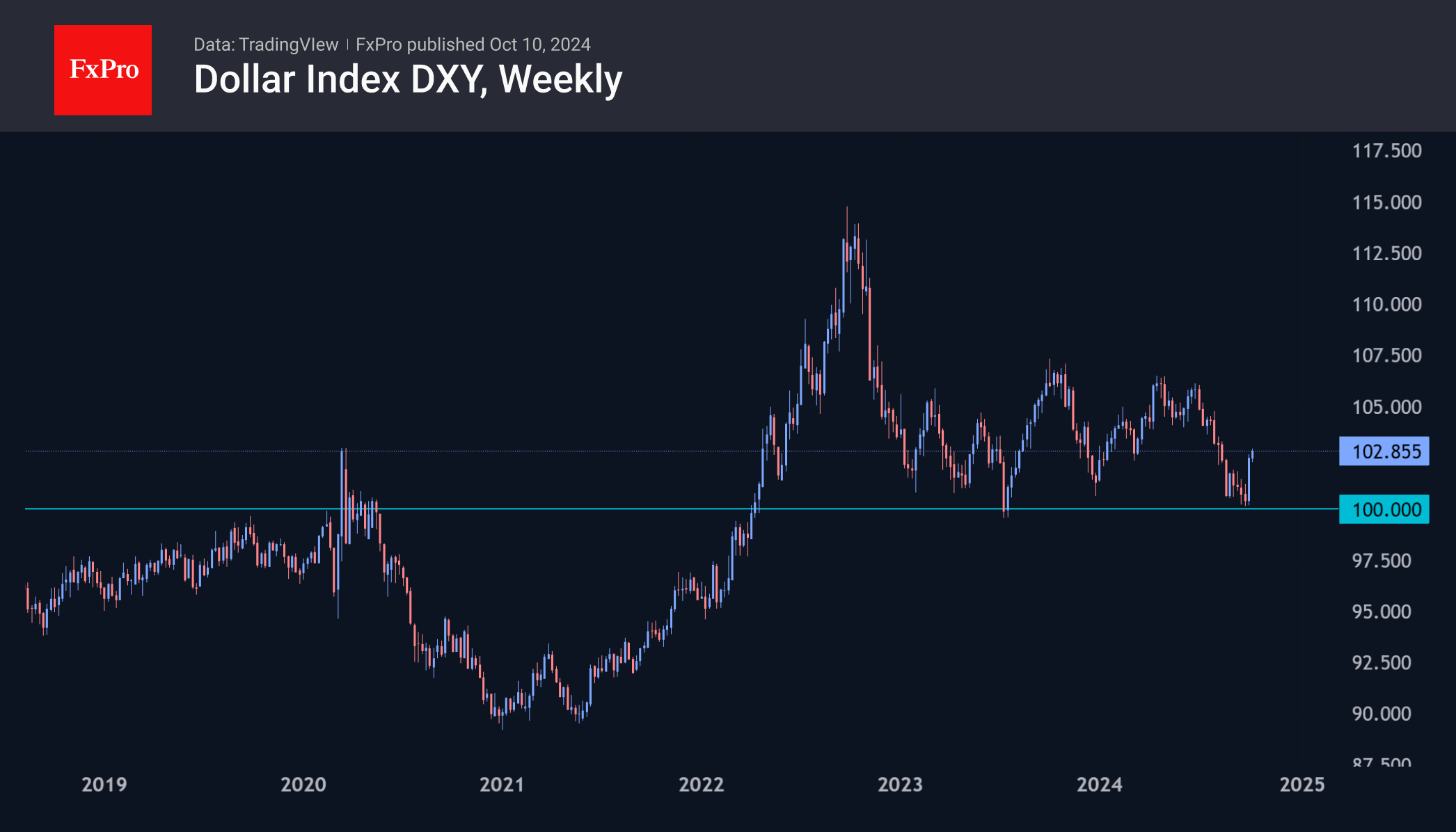

The US dollar is developing an offensive, adding almost daily against a basket of major currencies. This nearly 3% bounce from the lower end of the trading range of the last 2.5 years and the 100 level on the DXY is driven by a shift in expectations for the US Federal Reserve’s key rate.

A stream of strong data, including an influential jobs report for September, is restoring optimism about the US economy. However, this was not without ‘forward guidance’ from FOMC members and Chairman Powell, who relayed that rate cuts of 50 points at a time are not the new normal.

The futures market now projects a 16% chance of the rate remaining unchanged in November and an 84% chance of a 25-point cut. This is a dramatic shift from a fortnight ago when there was a 0% chance of keeping rates unchanged, a 42% chance of a 25-point cut, and a 58% chance of a 50-point cut.

Until the next FOMC meeting on 7 November, rate expectations will be influenced by today’s consumer inflation numbers and another employment report coming out on 1 November, which could significantly change expectations.

Market analysts forecast a 0.1% m/m rise in the overall price index vs. 0.2% previously and a slowdown in annual inflation from 2.5% to 2.3%. The rate of price growth, excluding food and energy, is expected to remain at 3.2%. In both cases, the rates are above the Fed’s target, and the core rate has stabilised in recent months.

Looking at the strong employment and consumer demand numbers, there are more risks of exceeding the consensus forecast than weaker core inflation data. In this case, the USD rally will get a new growth impetus by further closing shorts on the US currency.

We believe a 25-point rate cut scenario is more likely unless there is a sudden economic catastrophe. This could potentially lead to some weakening of the dollar. However, forex traders should keep in mind that the dollar will be affected by fluctuations in key rate expectations for 2-4 quarters, as it was a year earlier.

The FxPro Analyst Team