US inflation is out of control. Will the Fed make its move?

July 13, 2021 @ 16:25 +03:00

The US Consumer Price Index is rising despite forecasts and reassurances from the Fed. According to the latest data, prices rose by 0.9% in July against expectations of 0.5%. The year over year growth accelerated from 5.0% to 5.4% instead of the expected 4.9% slowdown. Core CPI growth reached 4.5%, with the index adding 0.9% in July for the second time in three months.

These data undermine the hope that the peak of inflation is over. As we can see, prices continue to accelerate, now at the expense of volatile energy and food prices and the cost of the core.

In such circumstances, it is logical to expect the Fed to tighten its rhetoric and hint at an imminent withdrawal of stimulus, as inaction by the regulator undermines confidence in it.

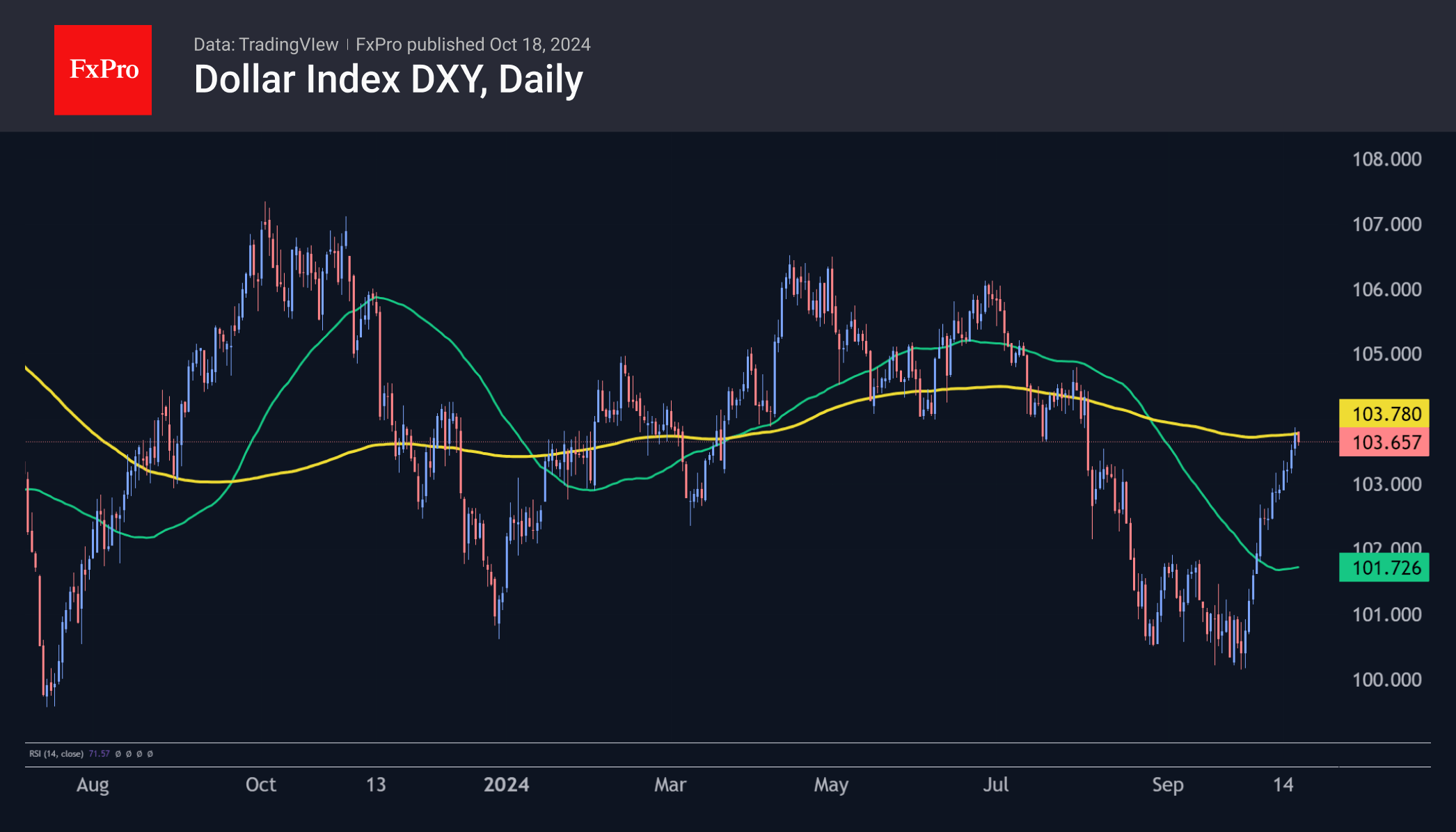

The market’s speculative reflex to inflation data is to buy the dollar and put pressure on equities in anticipation of the unwinding of stimulus and a reassessment of expectations of a rate hike. However, longer-term investors should wait for comments from the Fed. The reassurance from Powell and Co on the temporary nature of inflation promises to deal a blow to the dollar as markets will return to pricing in high inflation expectations and negative real yields.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks