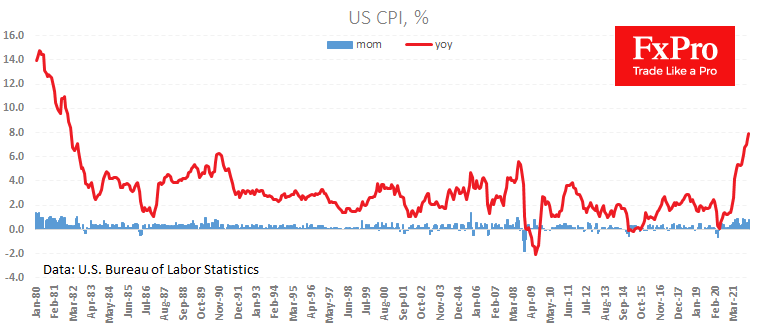

Consumer prices in the USA rose by 0.8% in February as expected. Inflation for the same month a year earlier was 7.9% compared to 7.5% a month earlier and in line with average forecasts.

Over the last 12 months, the actual data has exceeded the forecast ten times, so the stabilisation seen in February is regarded as cautiously good news. Previously, market participants had assumed that inflation would peak in February, but the latest round of commodity prices makes these forecasts overly optimistic.

In peacetime, markets would have priced in more decisive monetary policy tightening moves by the Fed. However, investors have recently discounted expectations of a rate hike by 50 points, contrary to a jump in commodity prices. The markets assume that the Fed will be much more cautious in tightening policy. This thesis is doubly true against the background of falling government bond yields and widening spreads between them and high-yield bonds.

When the Fed has limited capacity to respond to inflation, this is bad news for the dollar because it undermines its long-term prospects for maintaining purchasing power. In this regard, the impulsive pressure on the US currency immediately after the release should not be surprising.

Long term, this is also good news for bitcoin, which is not subject to inflation. However, the short-term reaction could well be mixed, as fears of a new stock market decline are also added to this cocktail, as stocks “don’t like” accelerating inflation.

The FxPro Analyst Team